Highlights

Financial and Outlook:

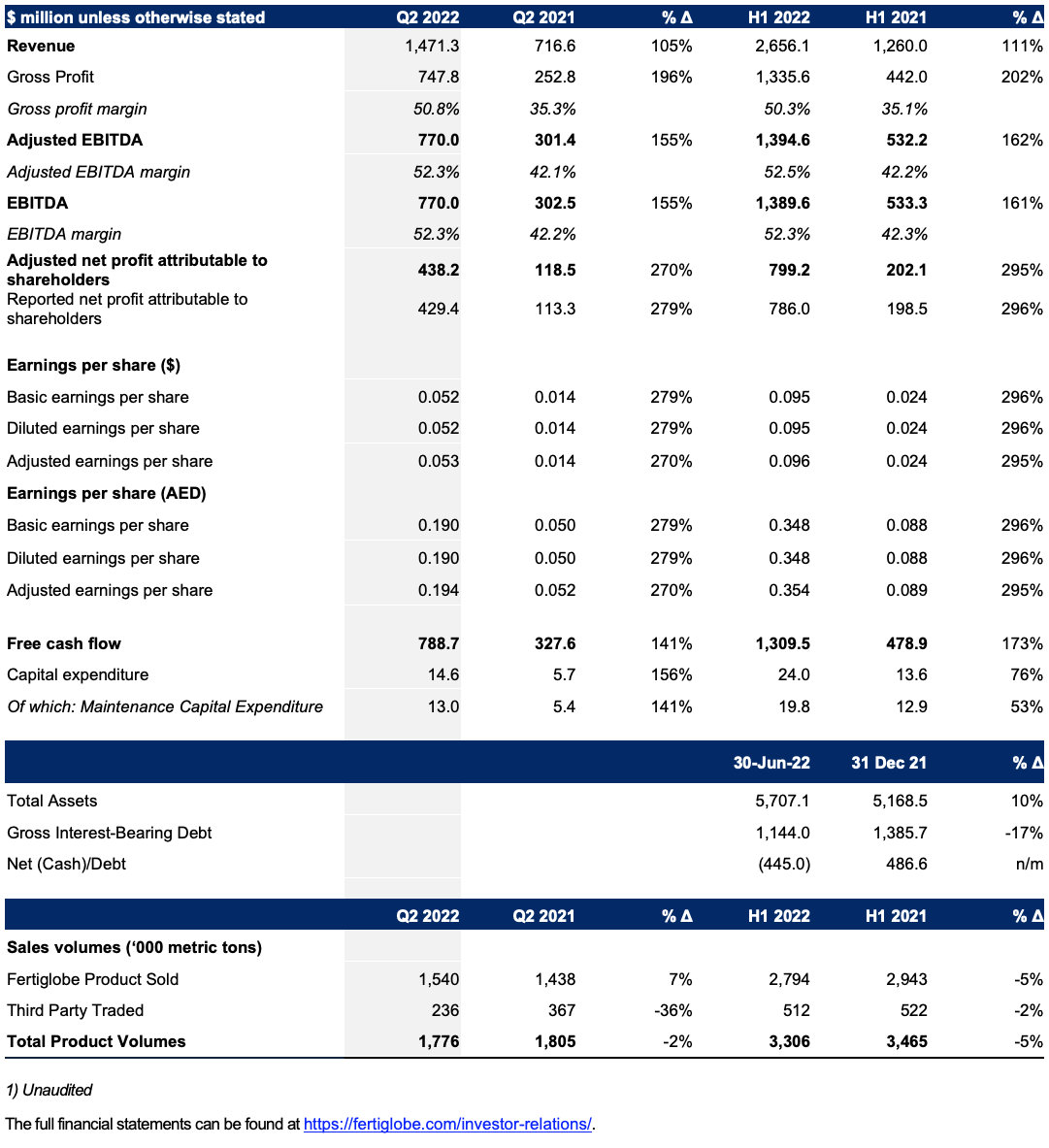

- Q2 2022 revenues increased 105% YoY to $1,471 million and adjusted EBITDA +155% YoY to $770 million, driven by higher selling prices and higher own-produced sales volumes as some deliveries were rephased from Q1 2022 at better netbacks.

- H1 2022 revenues increased 111% to $2,656 million YoY, while adjusted EBITDA was up 162% to $1,395 million.

- Adjusted net profit was $438 million in Q2 2022, an increase of 270% compared to $119 million in Q2 2021, and $799 million in H1 2022 compared to $202 million in H1 2021.

- Fertiglobe generated free cash flow of $789 million in Q2 2022, a 141% increase as compared to same period last year, and $1,310 million in H1 2022 versus $479 million in H1 2021. Net cash position of $445 million as of 30 June 2022 is supportive of growth opportunities and attractive dividend pay-out.

- H1 2022 dividends announced at $750 million (payable October 2022), above our guidance of at least $700 million.

- Favourable farm economics and low global grain stocks, combined with high gas prices in Europe, provide support for nitrogen selling prices to remain above historical averages

- Our attractive dividend outlook is further backed by Fertiglobe’s competitive position on the global cost curve and free cash flow conversion capacity. Fertiglobe remains committed to its policy of balancing distributions of all excess free cash flows after growth capex, while maintaining its investment grade parameters. More detailed guidance on the H2 2022 dividend will be provided with Q3 2022 results in November 2022.

Corporate Updates:

- In June 2022, Fertiglobe was issued first time investment grade ratings by S&P, Moody’s and Fitch (BBB-, Baa3 and BBB-, respectively), recognizing its strong free cash flow generation, conservative financial policy and robust outlook.

Abu Dhabi, UAE – 2 August 2022: Fertiglobe (ADX: FERTIGLB), the strategic partnership between ADNOC and OCI, the world’s largest seaborne exporter of urea and ammonia combined, the largest nitrogen fertilizer producer in the Middle East and North Africa (“MENA”) region, and an early mover in clean ammonia, today reported that its Q2 2022 revenues increased 105% to $1,471 million, while adjusted EBITDA grew 155% to $770 million compared to Q2 2021. Free cash flow increased to $789 million in Q2 2022 from $328 million in Q2 2021.

Ahmed El-Hoshy, Chief Executive Officer of Fertiglobe commented:

“Q2 2022 marks another quarter of solid performance, driven by a favourable price backdrop supported by strong in-season demand, tight market balances and elevated gas prices in Europe, as well as higher sales volumes due to a phasing of some shipments from Q1 2022 to this quarter. We are pleased to announce H1 2022 dividends at $750 million, above our previous guidance of at least $700 million, driven by robust earnings, healthy cash conversion and our capital structure.

We are also delighted to achieve investment grade credit ratings by three rating agencies: S&P (BBB-), Moody’s (Baa3) and Fitch (BBB-), supported by an attractive cash flow profile and a prudent financial policy.

In addition, Fertiglobe was included in the FTSE EM Index in June 2022, following its March 2022 inclusion in the FTSE ADX 15 Index, representing the 15 largest and most liquid companies on the Abu Dhabi Securities Exchange.

The outlook for the fundamentals of our nitrogen end markets continues to be underpinned by tight supply, healthy farm economics and low grain stocks globally that incentivize the use of nitrogen fertilizers. Forward curves imply that natural gas prices in Europe will remain at elevated levels through at least 2023, setting breakeven pricing well above historical average global prices for ammonia and urea.

We continue to focus on operational excellence and utilizing our young, world-scale production assets efficiently while fully capitalizing on global supply chains – in partnership with OCI – to capture the highest netbacks. We aim to fill supply gaps to help address global food security concerns, supported by our position as a leading producer and largest seaborne exporter globally of essential nitrogen fertilizer products.

Fertiglobe’s low leverage positions the company favorably to selectively pursue value-creative growth opportunities, including organic expansions below replacement cost, capitalizing on the emerging demand for low-carbon ammonia as a solution to decarbonize industries that make up around 90% of current global greenhouse gas emissions.

Finally, I would like to thank the Fertiglobe team for their efforts to deliver best-in-class performance and their focus on safety. We look forward to continuing to create value for all our stakeholders.”

Nitrogen outlook supported by crop fundamentals and high gas prices in Europe

Nitrogen product prices are supported by several market factors which suggest a structural shift to a multi-year demand driven environment.

- Nitrogen pricing has support to remain significantly above historical averages. European nitrogen producers are currently the marginal producer with the forward curve for natural gas implying elevated input costs for the medium term:

- Gas price futures in Europe currently indicate c.$60 / mmBtu for the balance of the year and $36 / mmBtu for 2023 and 2024, compared to $5 / mmBtu in the 2016 to 2020 period.

- At these higher feedstock prices, the costs for marginal producers in Europe imply support levels for ammonia at >$2,000/t for the balance of 2022 and >$1,300/t in 2023 / 2024 (excluding CO2 costs), which is 6-9x higher than the c.$230/t support level during 2016 – 2020.

- This translates into price support of >$1,200 / ton for urea for the balance of 2022 (and >$780 / ton in 2023 / 2024)

- Prices can drop below such floors particularly during off-season periods, but economics have historically prevailed when margins for producers remain negative for a sustained period, triggering shutdowns as has been occurring in Europe over the past 12 months.

- Nitrogen supply is structurally tighter over 2022 – 2026, resulting in an estimated market deficit of c.7 million tons for urea. In addition:

- In Europe, c.7 million tons of ammonia capacity out of a total 19 million tons is currently shut due to the high gas prices. Given elevated gas price futures and risks related to Russian gas supply, more capacity may be shut down should selling prices remain below gas-based production costs.

- Russian ammonia exports from the Black Sea are limited due to logistical constraints (impacting c.2 million tons ammonia or c.10% of global trade)

- Urea exports from China, needed to balance the markets, are expected to remain low over the medium term, with controls to curb exports in place until H2 2023 at least and prioritization for domestic supply

- Crop fundamentals remain supportive for nitrogen demand:

- Global grain stock-to-use ratio remains at decade lows and it will take at least until 2024 to replenish stocks

- Grain futures (US corn futures at 6.0 /bushel and wheat at $8.0 / bushel from H2 2022 till the end of 2024) remain at levels that incentivize farmers globally to maximize yields by using more nitrogen

- Disruptions to agricultural supply chains with reduced fertilizer application in some regions, dry weather, and a late US season is expected to defer demand into 2023 given relative inelasticity of nitrogen demand

Gas markets

Fertiglobe’s assets are favourably positioned on the global cost curve, and we are a net beneficiary of a higher global gas price environment. Fertiglobe has a significant competitive advantage with favourable gas price supply agreements, including fixed prices in Abu Dhabi and profit-sharing mechanisms in North Africa.

Dividends and capital structure

Fertiglobe’s dividend policy is to substantially pay out all excess free cash flows after providing for growth opportunities, while maintaining investment grade credit ratings (S&P: BBB-, Moody’s: Baa3, Fitch: BBB-; all with stable outlooks). Given the company’s free cash generation, Fertiglobe announced cash dividends of $750 million for H1 2022, above management guidance of at least $700 million. The dividend will be presented to shareholders for approval and is payable in October 2022.

Fertiglobe’s potential for attractive future dividends is supported by its cash flow performance and competitive position on the global cost curve. Strong earnings and cash generation during the quarter resulted in a net cash position of $445 million as of 30 June 2022, compared to net debt of $487 million as at 31 December 2021 (0.3x net debt / adjusted EBITDA), supporting future growth opportunities and an attractive dividend pay-out. Beyond H1 2022, Fertiglobe remains committed to its dividend policy of substantially distributing all excess free cash flows after providing for growth opportunities and maintaining its investment grade parameters. More detailed guidance on the H2 2022 dividend will be provided with Q3 2022 results in November 2022.

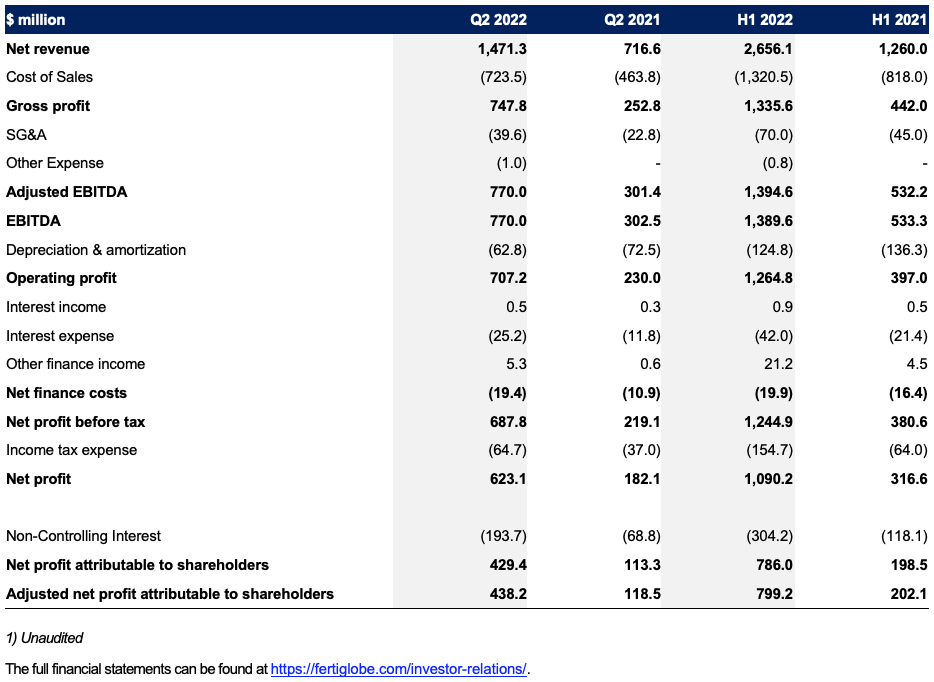

Consolidated Financial Results at a Glance1

Financial Highlights ($ million unless otherwise stated)

Operational Highlights

Highlights

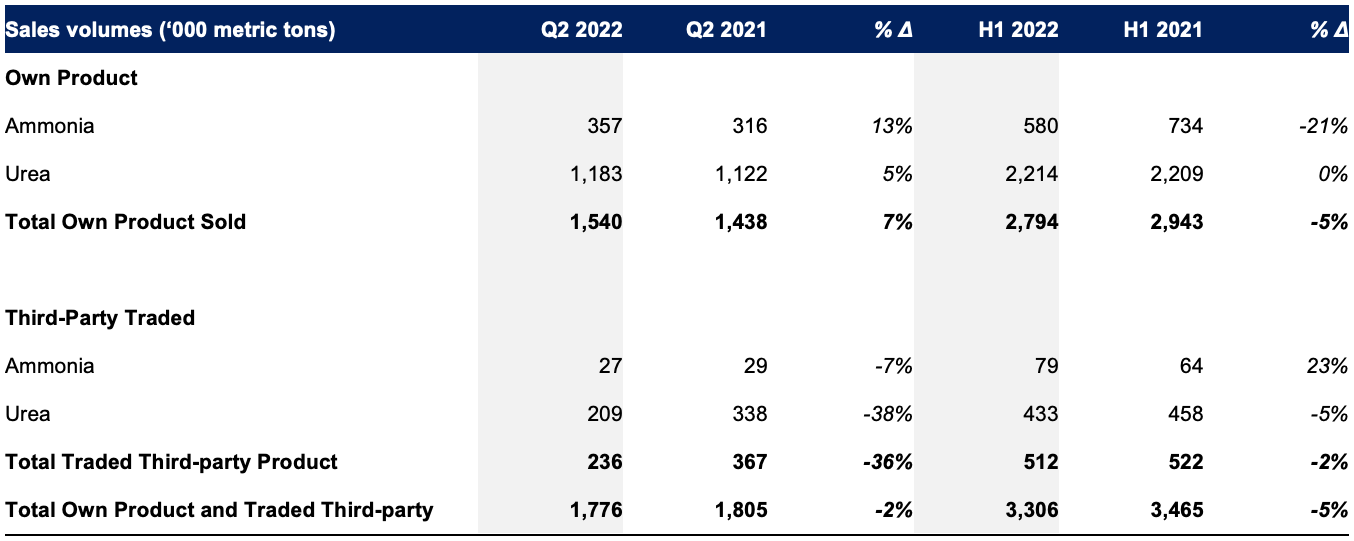

- Fertiglobe’s improved performance in Q2 2022 compared to Q2 2021 is due to an increase in selling prices year-on-year across its product portfolio, in addition to higher own-produced sales volumes due to a rephasing of some shipments to Q2 2022 from Q1 2022.

- Fertiglobe’s total own-produced sales volumes were up 7% to 1,540kt in Q2 2022 vs Q2 2021, driven by:

- A 13% increase in ammonia own-produced sales volumes to 357kt from 316kt in Q2 2021, and

- 5% higher urea own-produced sales volumes of 1,183kt YoY compared to 1,122kt in Q2 2021.

- Traded third party volumes decreased 36% YoY to 236kt in Q2 2022, compared to 367kt in Q2 2021.

- Total own-produced and traded third party volumes were 2% lower in Q2 2022, compared to Q2 2021, due to lower third party traded volumes.

- In H1 2022, Fertiglobe’s total own-produced sales volumes were down 5% to 2,794kt compared to H1 2021, driven by:

- A 21% decrease in ammonia own-produced sales volumes to 580kt from 734kt in H1 2021, and

- Relatively unchanged urea own-produced sales volumes of 2,214kt.

- Traded third party volumes were down marginally (-2% YoY) to 512kt in H1 2022.

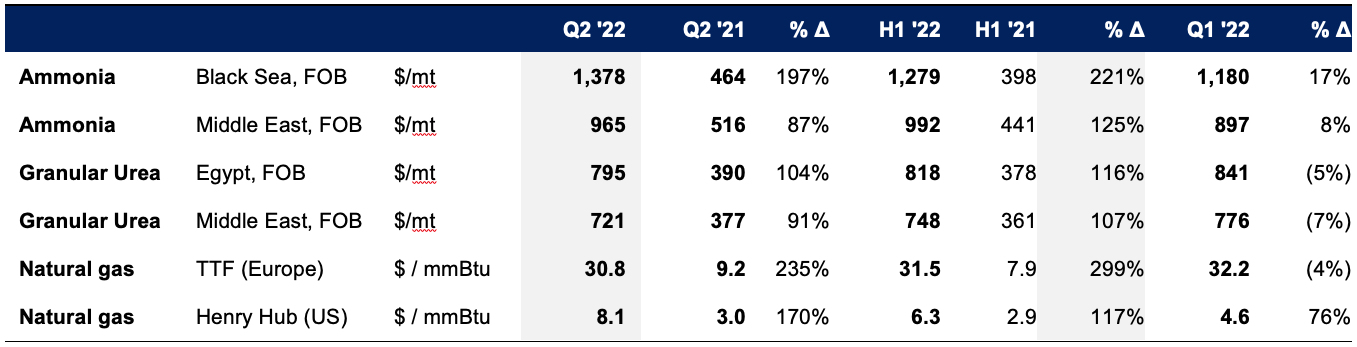

- Middle East ammonia and Egypt urea benchmark prices were 87% and 104% higher YoY, respectively, in Q2 2022 (+8% and -5% compared to Q1 2022).

Product Sales Volumes (‘000 metric tons)

Benchmark Prices

Operational Performance

Total own-produced sales volumes were up 7% during the second quarter of 2022 to 1,540kt compared to the same period last year, mainly due to a rephasing of urea and ammonia shipments to Q2 2022.

Ammonia and urea selling prices were well above prices seen in Q2 2021, with ammonia Middle East benchmark up 87% YoY and the urea Egypt benchmark price up 104%. Compared to Q1 2022, the ammonia Middle East benchmark was up 8%, while the urea Egypt benchmark price was down 5%. The higher selling prices resulted in a 105% YoY increase in revenues to $1,471 million in Q2 2022. This translated into a 155% increase in adjusted EBITDA to $770 million in Q2 2022 from $301 million in Q2 2021. As a result, Fertiglobe’s adjusted EBITDA margin expanded to 52.3% in Q2 2022 from 42.1% in Q2 2021.

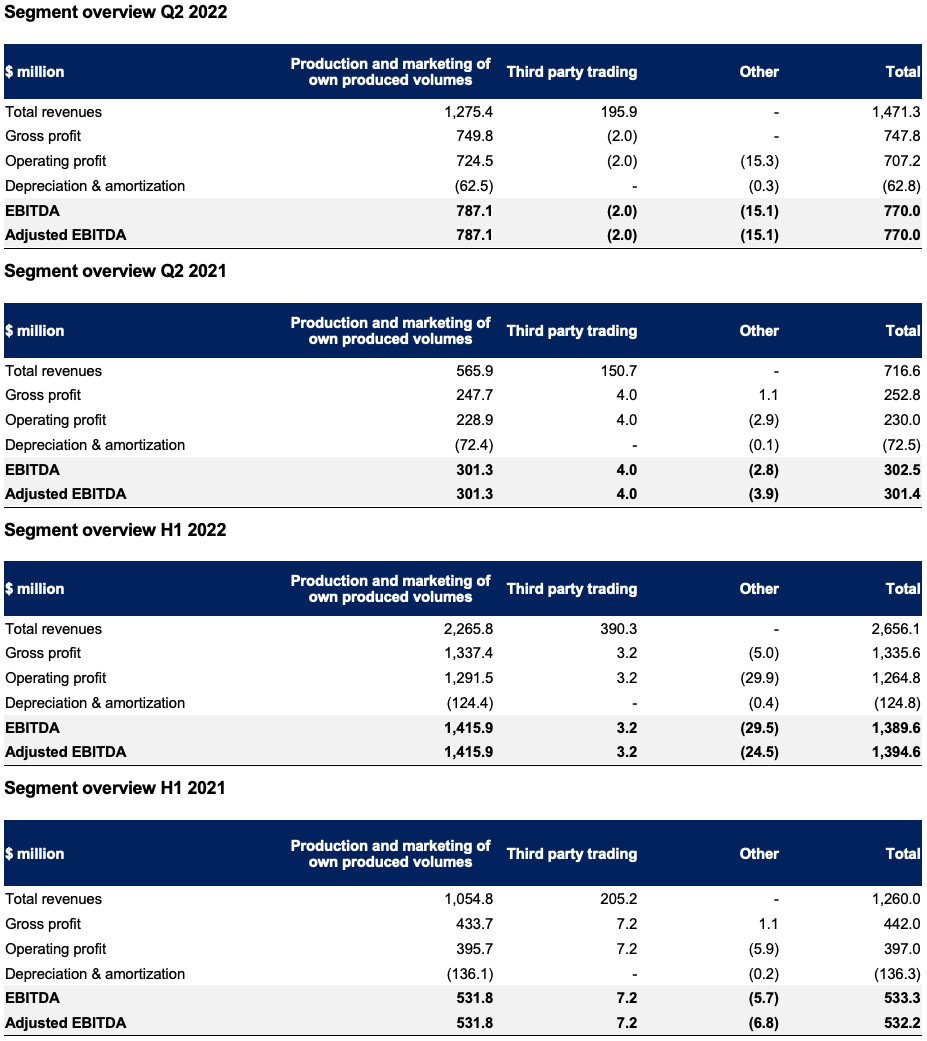

Financial Highlights

Summary results

Consolidated revenue increased by 105% to $1,471 million in the second quarter of 2022 compared to the same quarter in 2021, driven by higher prices across the board of Fertiglobe’s product portfolio.

Adjusted EBITDA grew 155% YoY to $770 million in Q2 2022 compared to $301 million in Q2 2021. Fertiglobe benefited from higher selling prices during the quarter as well as higher sales volumes of own produced urea and ammonia, which have more than offset higher profit sharing.

Q2 2022 adjusted net profit was $438 million compared to an adjusted net profit of $119 million in Q2 2021. Reported net profit attributable to shareholders was $429 million in Q2 2022 compared to a net profit attributable to shareholders of $113 million in Q2 2021.

Consolidated Statement of Income 1

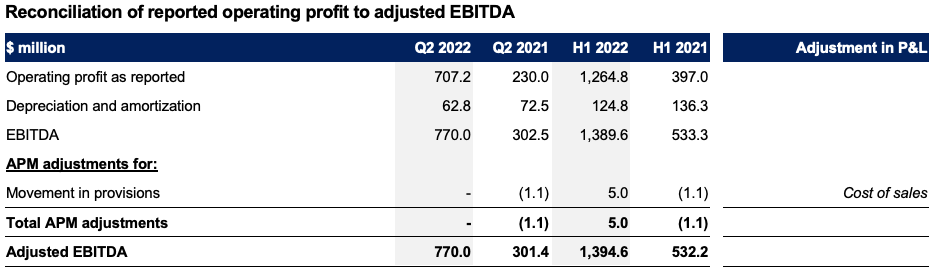

Reconciliation to Alternative Performance Measures

Adjusted EBITDA

Adjusted EBITDA is an Alternative Performance Measure (APM) that intends to give a clear reflection of underlying performance of Fertiglobe’s operations.

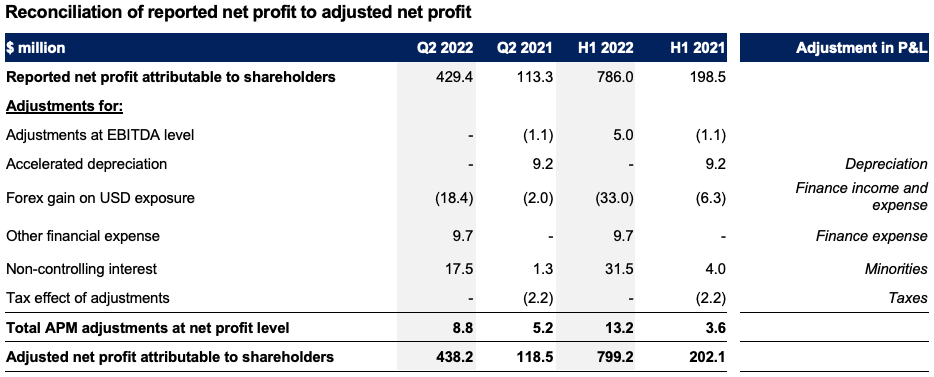

Adjusted net profit attributable to shareholders

At the net profit level, the main APM adjustments relate to the impact on non-cash foreign exchange gains on US$ exposure, accelerated depreciation and other financial expenses.

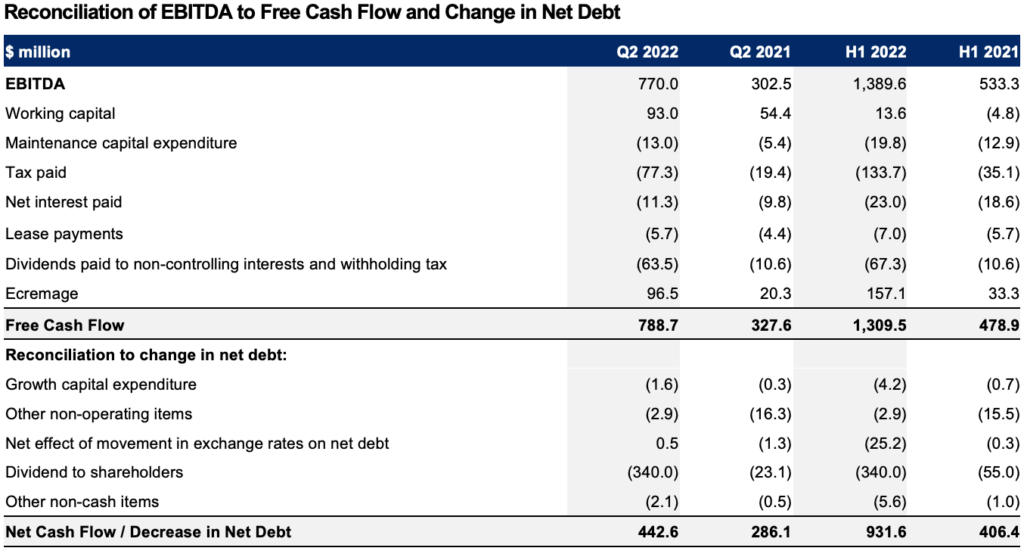

Free Cash Flow and Net Debt

Free cash flow before growth capex amounted to $789 million during Q2 2022, compared to $328 million during the same period last year, reflecting performance for the quarter, taxes and maintenance capital expenditures.

Total cash capital expenditures including growth capex were $15 million in Q2 2022 compared to $6 million in Q2 2021. Management continues to expect 2022 capital expenditures (excluding growth capital expenditure) to be in the range of $120-140 million.

الاجتماع الهاتفي للمستثمرين والمحللين

في 2 أغسطس 2022 الساعة 3:30 مساءً بتوقيت دولة الإمارات العربية المتحدة (12:30 مساءً بتوقيت لندن، و7:30 صباحاً بتوقيت نيويورك)، ستستضيف شركة “فيرتيغلوب” اجتماعاً عبر الهاتف للمستثمرين والمحللين. للاشتراك في الاجتماع، يرجى الاتصال بـ:

الرقم الدولي: +44 20 3936 2999

الإمارات العربية المتحدة: 0800 0357 04553

المملكة المتحدة: 020 3936 2999 / الرقم المجاني: 0800 640 6441

الولايات المتحدة: 1 646 664 1960 / الرقم المجاني: 1 855 9796 654

الرقم التعريفي للاجتماع: 055635

نبذة عن فيرتجلوب:

فيرتجلوب هي أكبر مُصدِّر بحري على مستوى العالم لليوريا والأمونيا مجتمعتين، وهي شركة رائدة في مجال الأمونيا النظيفة. تشمل الطاقة الإنتاجية لشركة فيرتجلوب إنتاج 6.7 مليون طن من اليوريا والأمونيا التجارية في أربع شركات تابعة كائنة في دولة الإمارات العربية المتحدة ومصر والجزائر، مما يجعلها أكبر منتج لمخصبات النيتروجين في الشرق الأوسط وشمال أفريقيا، وهي تستفيد من الوصول المباشر إلى ست موانئ ومراكز توزيع رئيسية على البحر المتوسط والبحر الأحمر والخليج العربي. تأسست الشركة في سوق أبوظبي العالمي ويقع مقرها في إمارة أبوظبي، وهي توظف ما يربو على 2600 موظف وتشكلت كشراكة استراتيجية بين OCI N.V. (“OCI”) وشركة بترول أبوظبي الوطنية (“أدنوك”). وشركة فيرتجلوب مدرجة في سوق أبوظبي للأوراق المالية تحت الرمز “FERTIGLB” برقم تعريف دولي للأوراق المالية “AEF000901015”. للاطلاع على المزيد، يرجى زيارة: www.fertiglobe.com

لإستفسارات المستثمرين، يرجى التواصل مع

قسم علاقات المستثمرين

ريتا جندي

[email protected]

هانس زايد

[email protected]

لمزيد من المعلومات عن فيرتيجلوب:

www.fertiglobe.com