Highlights:

- Fertiglobe reported Q2 2023 revenues and adjusted EBITDA at $552 million and $218 million, respectively. Adjusted net profit and free cash flows during the quarter were $84 million and $60 million, respectively.

- Fertiglobe’s H1 2023 revenues and adjusted EBITDA were $1,245 million and $516 million, respectively. Adjusted net profit was $219 million in H1 2023, while free cash flows were $331 million.

- In line with guidance, Fertiglobe’s management proposed H1 2023 dividends of at least $250 million (subject to Board approval in September 2023), underscoring the company’s commitment to creating and returning

shareholder value. The exact payment date in October 2023 will be announced following Board approval.

- Fertiglobe is making progress with its cost optimization initiatives and is on track to deliver $50 million in annualized run rate savings as of the end of 2024. Approximately 25-30% of the run rate savings are

expected to be realized by the end of 2023, with the rest to be realized over 2024.

- Fertiglobe is making progress with its sustainability-focused projects and is expected to start the Front End Engineering Design (FEED) process for its green hydrogen to ammonia projects in the UAE and Egypt

during H2 2023. In addition, the final investment decision (FID) on the Ta’ziz 1mtpa low carbon ammonia project is expected in the coming months.

- Market Outlook:

- Nitrogen prices bottomed in Q2 and have begun rebounding into Q3, with Egypt urea prices up ~60% from trough levels in June 2023, underpinned by demand recovery, record low inventories and very tight supply.

- Decade-low grain stocks driving rising crop futures and favorable farm economics incentivize significant increases in nitrogen demand, and support nitrogen price recover.

- New capacity that was added and ramped up during 2022 and early 2023 has been absorbed, with limited new supply additions expected in the next four years

- Warm weather is leading to higher gas demand for residential cooling, and causing reductions in global ammonia production in some countries as a result

Abu Dhabi, UAE – 02 August 2023: Fertiglobe (ADX: FERTIGLB), the strategic partnership between ADNOC and OCI Global, the world’s largest seaborne exporter of urea and ammonia combined, the largest nitrogen fertilizer producer in the Middle East and North Africa (“MENA”) region, and an early mover in sustainable ammonia, today reported Q2 2023 revenue of $552 million, adjusted EBITDA of $218 million, adjusted net profit of $84 million, and free cash flow of $60 million. Q2 2023 results were impacted by lower selling prices, as volatility in European gas prices continued while markets saw increased supply from capacities commissioned in 2022, coinciding with the end of the demand season in the northern hemisphere.

Ahmed El-Hoshy, CEO of Fertiglobe, commented:

“We are pleased to see that nitrogen markets bottomed during the second quarter and are tightening rapidly, with a strong price trajectory in recent weeks despite the traditional summer lull for fertilizers. Looking ahead, we believe that limited incremental supply additions over the next several years, coupled with healthy farm economics, which incentivize nitrogen fertilizer application, and elevated marginal production costs in Europe continue to support a favorable nitrogen outlook in the medium to longer term. We expect more permanent closures of European marginal production, if ammonia pricing continues to persist below marginal production costs.

Our overall sales volumes were lower compared to Q2 2022, primarily due to a higher base effect given deferrals from Q1 to Q2 last year. However, going into H2 2023, we are well-positioned to service demand emerging from key regions, leveraging our centralized distribution capabilities and targeting demand centers that offer the highest netbacks, further supported by the reinstatement of urea and ammonia import duties into Europe.

We are excited to continue to diversify our product offering via Diesel Exhaust Fuel (DEF) sales from our plants in Egypt into Europe, where demand for the product is supported by increasingly stricter emission regulations. We also continue to progress our sustainability-focused projects, including the Ta’ziz 1mtpa low carbon ammonia project and the low carbon ammonia pilot in the UAE at Fertil. We expect to commence the Front End Engineering Design (FEED) process for our green hydrogen project in the UAE and our full scale green hydrogen project in Egypt during H2 2023. We continue to take significant steps towards achieving a more sustainable footprint for our production as well as for others. We look forward to providing further updates in the coming months.

Our solid balance sheet position and cash flow management allow us to pursue these growth initiatives while also balancing shareholder returns. We are pleased to propose H1 2023 dividends of at least $250 million or the equivalent of at least AED 11 fils per share, subject to board approval, expected to be paid during October 2023.

As previously highlighted, we are actively implementing several management initiatives aimed at supporting our free cash generation across cycles. Our cost optimization initiatives target $50 million in recurring annualized savings by the end of 2024, with 25-30% of these savings planned to be achieved this year. Our key focus areas include operating model enhancements and improvements in logistical capabilities (together contributing ~60% of the run rate savings) as well as operational cost and spending efficiencies. In addition, we are already starting to see positive results from our manufacturing improvement plan, and are on track to deliver operational and cost efficiencies by 2025. The commitment of the Fertiglobe team to maintaining best-in-class safety, performance, and excellence standards is a significant factor in driving our success, and I am very thankful for their dedication.”

Market Outlook

Fertiglobe believes the outlook for nitrogen markets continues to be supported by crop fundamentals, elevated European gas pricing and tightening supply dynamics in the medium-term

- Nitrogen prices bottomed in Q2 and have begun rebounding into Q3, underpinned by several factors, including:

- Demand recovery: The recent decline in nitrogen pricing has improved affordability for farmers by ~20% since January 2023 and more than 30% since Q2 2022, accelerating demand growth or nitrogen

- Record low inventory levels: The 2022-2023 fertilizer application season concluded with the lowest inventory levels in the past five years particularly in North America

- Tightening supply: The new capacity that was added and ramped up during 2022 and early 2023 has been absorbed, with limited new supply additions in the next four years

- El Niño impact: The rapid emergence of El Niño has raised concerns about crop yields in the southern hemisphere, which could lead to higher crop prices, supporting the use of nitrogen fertilizers in the medium-term; it is also reducing gas availability for the production of ammonia

- Normalization of trade flows: Following the EU’s removal of duty suspension on ammonia and urea in June 2023, with North African product exempt, Fertiglobe is expected to benefit from a normalization of trade flows

- India imports to step up: it is expected that import demand from India will increase from 2.5 Mt in H1 to ~4 Mt urea in H2 2023, with potential further upside in H2 due to recent rains and flooding, an earlier-than-expected new tender, and recent reduced domestic production run-rates

- Medium to long term nitrogen fundamentals also remain healthy, with anticipated demand recovery supporting the rebuilding of global grain stocks and a return of industrial demand:

- Global grain stock-to-use ratios remain at the lowest levels in 20 years, and it will likely take at least until 2025 to replenish stocks

- Forward grain prices (US corn futures >$5/bushel to the end of 2025 compared to $3.7/bushel during 2015 – 2019, and US wheat futures >$7/bushel, compared to $4.8/bushel during 2015 – 2019) support farm incomes and incentivize nitrogen demand to be above historical trend levels

- Ammonia markets appear to have stabilized, with higher cost economics, particularly in the East of Suez region, setting a firm floor. The increased fertilizer demand due to improved affordability is currently offsetting the lag in industrial demand recovery.

- Industry consultants expect a recovery in global ammonia trade from trough levels of ~17 million tons in 2022 and 2023 back towards historical levels of ~19+ million tons per annum

- Nitrogen supply is expected to be tighter over 2023 – 2027:

- In 2022, 6 million tons of new urea capacity were commissioned, with some plants ramping up in 2023, but now largely absorbed

- Industry consultants do not anticipate any major greenfield urea supply additions in 2023 and limited additions from 2024 to 2027, located mostly in Russia, generating a global supply/demand gap of ~4 million tons

- Chinese urea exports are expected to remain low over the medium term, in the range of 3 mtpa

- Feedstock pricing is expected to remain well above historical averages:

- Despite a recent drop in gas prices, 2023 – 2025 forward European gas prices are c.$15/mmBtu (or c.3x higher than 2015-2019), with higher prices anticipated for next winter

- It is expected that El Niño could increase the demand for natural gas for summer cooling, which could result in upward pressure on natural gas prices and increased marginal cost of nitrogen production

- Current ammonia prices are below the marginal cash cost producer in Europe:

- The gas forwards imply marginal cost support levels for ammonia of c.$750/t (including full impact CO2) and ~$590/t (excluding CO2) for next winter and 2024, which could result in temporary or permanent closures of European marginal production if pricing remains below cost for an extended period

Dividends and capital structure

As at the end of June 2023, Fertiglobe reported a net debt position of $66 million, compared to a net cash of $287 million as of 31 December 2022, allowing the company to balance future growth opportunities and dividend pay-out. Fertiglobe’s management proposed H1 2023 dividends of at least $250 million, in line with guidance, subject to board approval in September 2023. Payment is expected to follow in October 2023.

Cost savings

Fertiglobe recently launched an initiative to further optimize its cost structure and reinforce its top quartile cash cost positioning, targeting $50 million in recurring annualized savings by the end of 2024, of which 25-30% are planned to be achieved this year. Key focus areas will be operating model enhancements, improvement in logistical capabilities and operational cost and spend efficiencies. In addition, Fertiglobe’s manufacturing improvement plan is on track to deliver operational and cost efficiencies by 2025.

Consolidated Financial Results at a Glance

Financial Highlights ($ million, unless otherwise stated)

Operational Highlights

Operational Performance Highlights:

- 12-month rolling recordable incident rate to 30 June 2023 of 0.13 incidents per 200,000 manhours.

- Ammonia and urea production volumes were higher YoY in Q2 2023 despite the turnaround at Sorfert (Algeria).

- Fertiglobe’s Q2 2023 performance was impacted by lower selling prices as well as lower sales volumes compared to the same period last year, primarily due to a high base effect given deferrals from Q1 2022 to Q2 2022 and higher ammonia ending inventories in Q2 2023.

- Fertiglobe’s total own-produced sales volumes were down 8% to 1,414kt in Q2 2023 vs Q2 2022, driven by:

- A 19% decrease in ammonia own-produced sales volumes to 290kt from 357kt in Q2 2022

- A 6% decrease in urea own-produced sales volumes to 1,117kt YoY compared to 1,183kt in Q2 2022

- Traded third party volumes decreased 37% YoY to 148kt in Q2 2023, compared to 236kt in Q2 2022.

- Total own-produced and traded third party volumes of 1,562kt were down 12% in Q2 2023 compared to Q2 2022.

- In H1 2023, Fertiglobe’s total own-produced sales volumes were down marginally by 1% to 2,777kt compared to H1 2022, driven by:

- A 9% decrease in ammonia own-produced sales volumes to 526kt from 580kt in H1 2022, and

- Relatively unchanged urea own-produced sales volumes of 2,244kt.

- Traded third party volumes were down 39% YoY to 313kt in H1 2023.

- Total own-produced and traded third party volumes of 3,090kt were down 7% in H1 2023 compared to H1 2022.

Product sales volumes

Benchmark prices

In Q2 2023, ammonia Middle East benchmark were down 73% YoY, while the urea Egypt benchmark price was down 58%. Compared to Q1 2023, the ammonia Middle East benchmark was down 58%, while the urea Egypt benchmark price was down 18%.

The decrease in sales volumes and selling prices during the quarter resulted in a 63% YoY decrease in revenues to $552 million in Q2 2023. This translated into a 72% decline in adjusted EBITDA to $218 million in Q2 2023 from $770 million in Q2 2022. As a result, Fertiglobe’s adjusted EBITDA margin dropped to 40% in Q2 2023 from 52% in Q2 2022.

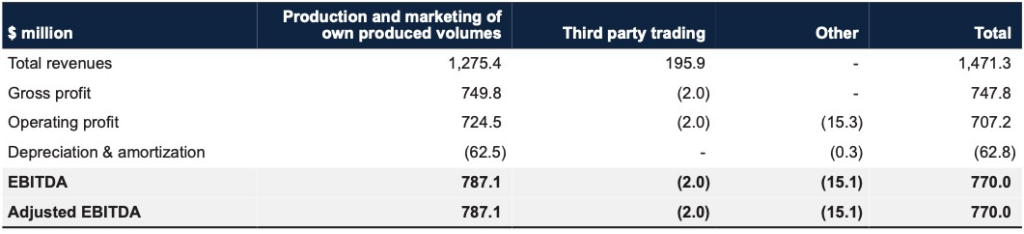

Segment overview Q2 2023

Segment overview Q2 2023

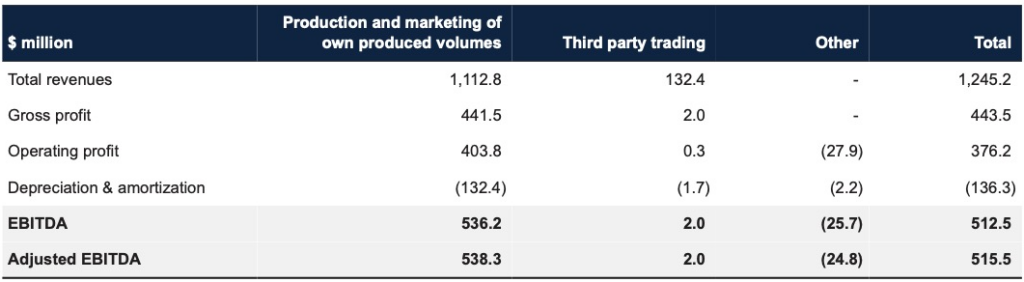

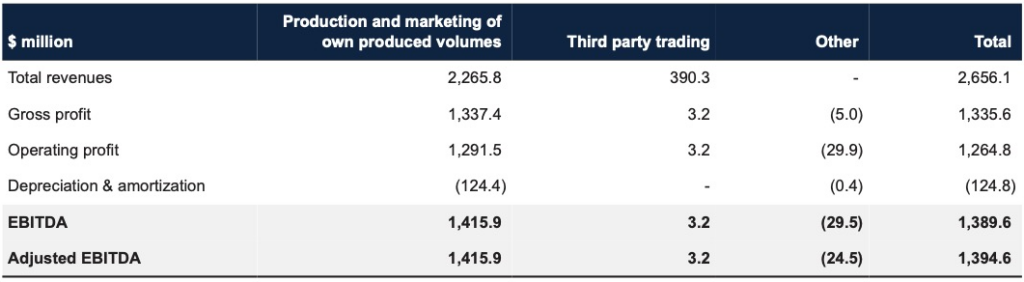

Segment overview H1 2023

Segment overview H1 2023

Financial Highlights

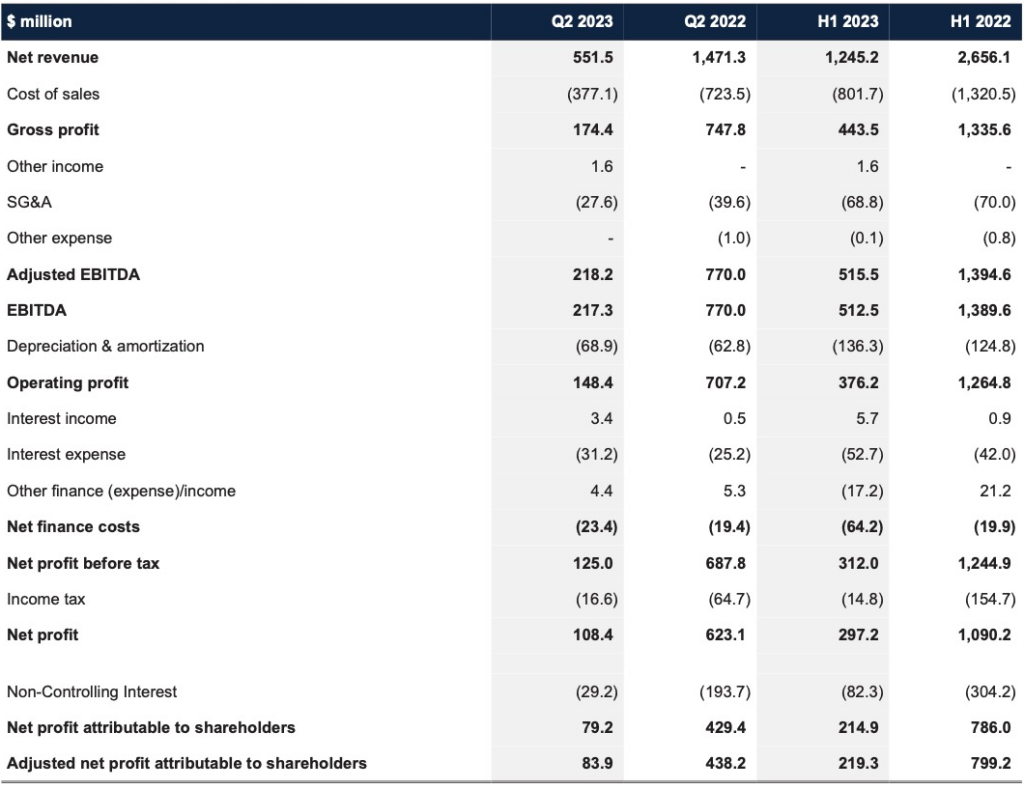

Summary results

Consolidated revenue decreased by 63% to $552 million in the second quarter of 2023 compared to the same quarter in 2022, driven by lower selling prices and sales volumes.

Adjusted EBITDA declined by 72% YoY to $218 million in Q2 2023 compared to $770 million in Q2 2022.

Q2 2023 adjusted net profit attributable to shareholders was $84 million compared to an adjusted net profit attributable to shareholders of $438 million in Q2 2022. Reported net profit attributable to shareholders was $79 million in Q2 2023 compared to a net profit attributable to shareholders of $429 million in Q2 2022.

Consolidated statement of income

Reconciliation to Alternative Performance Measures

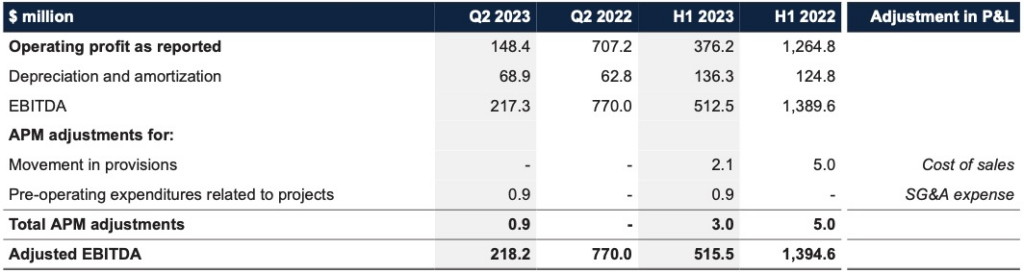

Adjusted EBITDA

Adjusted EBITDA is an Alternative Performance Measure (APM) that intends to give a clear reflection of underlying performance of Fertiglobe’s operations. The main APM adjustments at the EBITDA level relate to the movement in provisions and pre-operating expenditures related to projects during the quarter.

Reconciliation of reported operating income to adjusted EBITDA

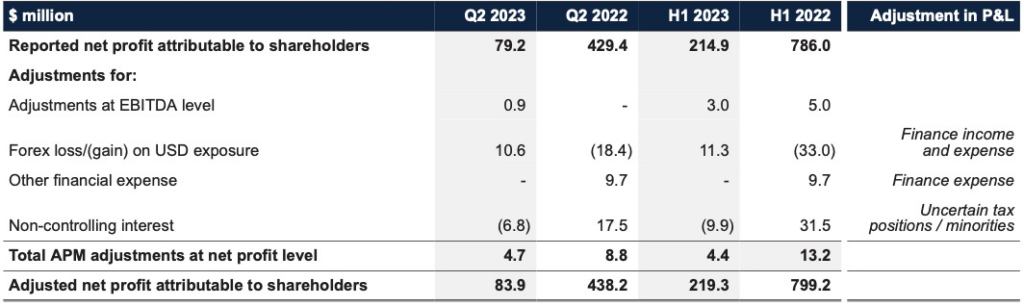

Adjusted net profit attributable to shareholders

At the net profit level, the main APM adjustments relate to the impact on non-cash foreign exchange gains and losses on USD exposure as well as non-controlling interest.

Reconciliation of reported net profit to adjusted net profit

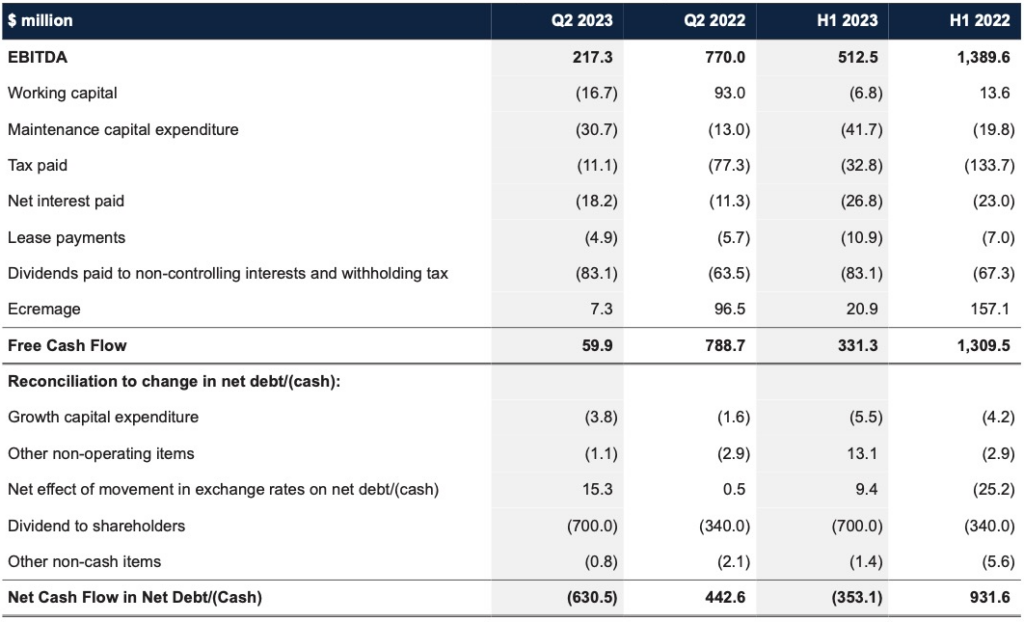

Free Cash Flow and Net Debt/(Cash)

Free cash flow before growth capex amounted to $60 million during Q2 2023, compared to $789 million during the same period last year, reflecting performance for the quarter, dividends paid to non-controlling interest and withholding tax, working capital outflows, maintenance capital expenditures, interest and lease payments.

Total cash capital expenditures including growth capex were $35 million in Q2 2023 compared to $15 million in Q2 2022, of which $31 million was related to maintenance capital expenditures, compared to $13 million in the previous year. For 2023, management maintains its guidance for capital expenditures (excluding growth capital expenditure) of $100-130 million.

Reconciliation of EBITDA to Free Cash Flow and Change in Net Debt/(Cash)

Investor and Analyst Conference Call

On 2 August 2023 at 3:00 PM UAE (12:00 PM London, 9:00 AM New York), Fertiglobe will host a conference call for investors and analysts. To access the call please dial:

Passcode: 996655

Participants may also join via the webcast. Please pre-register and join here.

About Fertiglobe:

Fertiglobe is the world’s largest seaborne exporter of urea and ammonia combined, and an early mover in clean ammonia. Fertiglobe’s production capacity comprises of 6.7 million tons of urea and merchant ammonia, produced at four subsidiaries in the UAE, Egypt and Algeria, making it the largest producer of nitrogen fertilizers in the Middle East and North Africa (MENA), and benefits from direct access to six key ports and distribution hubs

on the Mediterranean Sea, Red Sea, and the Arab Gulf. Headquartered in Abu Dhabi and incorporated in Abu Dhabi Global Market (ADGM), Fertiglobe employs more than 2,600 employees and was formed as a strategic partnership between OCI N.V. (“OCI”) and the Abu Dhabi National Oil Company (“ADNOC”). Fertiglobe is listed on the Abu Dhabi Securities Exchange (“ADX”) under the symbol “FERTIGLB” and ISIN “AEF000901015. To find out more, visit: www.fertiglobe.com.

Fertiglobe Investor Relations

Rita Guindy

Director

[email protected]

Hans Zayed

Director

[email protected]

For additional information on Fertiglobe: