Financial and Outlook

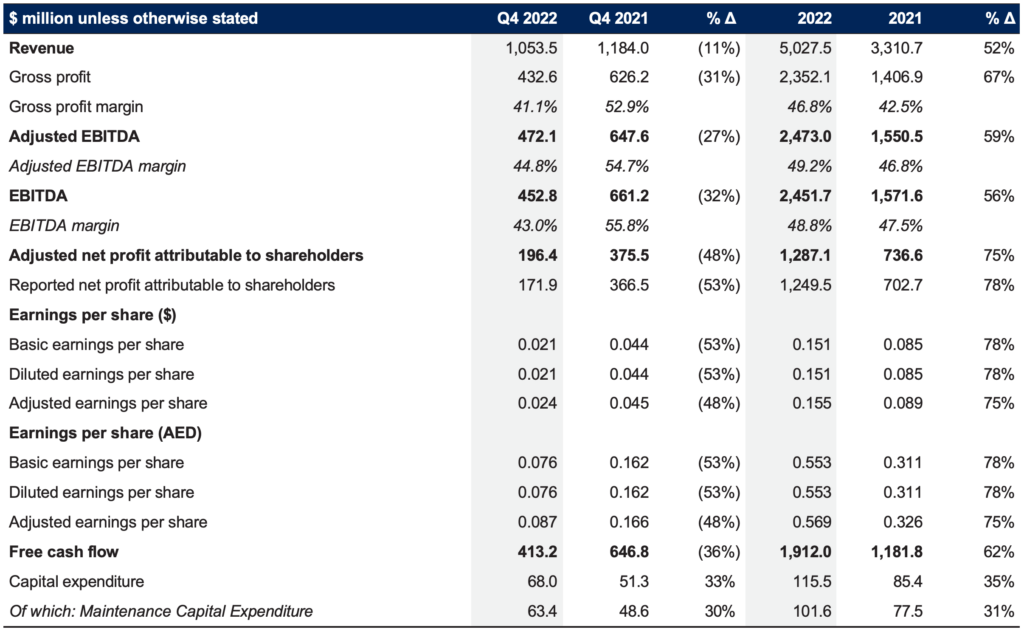

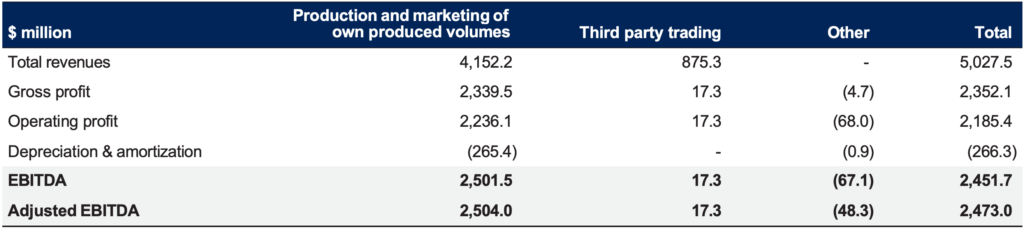

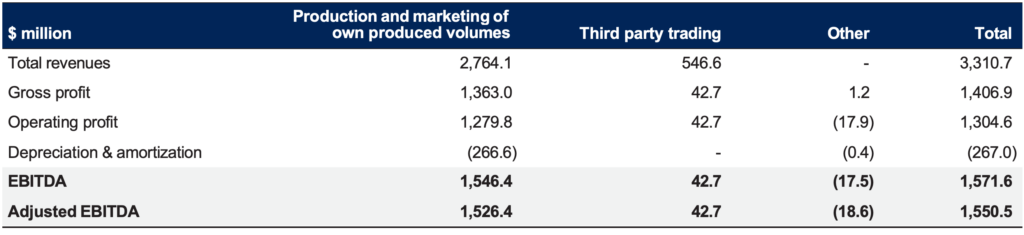

- 2022 revenues increased 52% to $5,028 million YoY, while adjusted EBITDA was up 59% to $2,473 million, and adjusted net profit increased 75% to $1,287 million compared to $737 million in 2021.

- Q4 2022 revenues and adjusted EBITDA decreased to $1,054 million and $472 million, respectively, compared to $1,184 million and $648 million in Q4 2021, driven by lower urea prices and major turnarounds in the UAE and Egypt during the quarter. Adjusted net profit was $196 million in Q4 2022 compared to $376 million in the same period last year.

- 2022 free cash flow (FCF) was $1,912 million versus $1,182 million in 2021 and $413 million in Q4 2022.

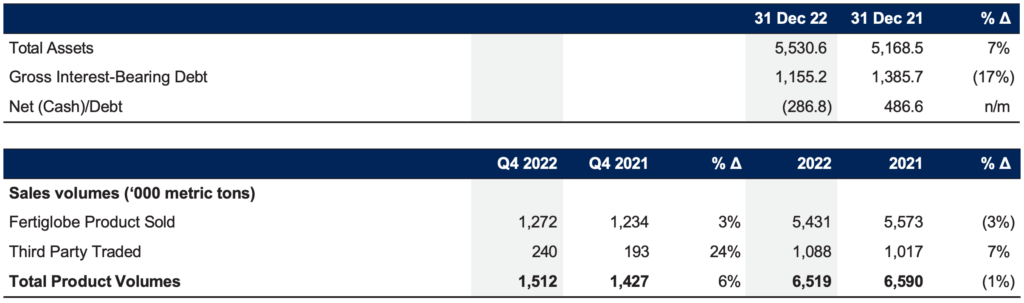

- Fertiglobe’s consolidated leverage position (net cash: $287 million as of 31 December 2022) continues to be supportive of potential growth opportunities as well as an attractive dividend payout.

- In December 2022, Fertiglobe refinanced the outstanding $900 million bridge loan facility with new 3-year ($300 million) and 5-year ($600 million) term facilities and increased the capacity of its Revolving Credit Facility (RCF) from $300 million to $600 million.

- Fertiglobe announced H2 2022 dividends at $700 million or the equivalent of AED 0.31 per share, in line with its previous guidance. The dividend will be presented to shareholders for approval at the next Annual General Meeting (date to be announced) and is payable in April 2023.

- Despite recent declines in European gas and nitrogen fertilizer markets, fundamentals for nitrogen and farm economics are healthy, with demand expected to recover in 2023 to support the rebuilding of decades-low global grain stocks which will take at least until 2025.

- In Q4 2022 and early 2023, Fertiglobe made trial shipments of Diesel Exhaust Fuel (DEF / AdBlue®) from Egypt to Europe, demonstrating its versatility, and expects to deliver more shipments in 2023.

Growth Initiatives

- Fertiglobe is making progress with its sustainability-focused growth projects, including:

- Egypt Green Hydrogen: After the start of commissioning of the first phase in 2022, engineering and technology choices for the full-scale 100 MW plant are now being evaluated, targeting FID during 2023.

- We received the ISCC Plus certification for renewable ammonia production from our Egypt facilities during Q4 2022, an important milestone setting the stage for future exports.

- The 1 million ton low-carbon ammonia project in the UAE: Following the signing announcement of the Shareholders’ Agreement in January 2023, on behalf of the project, Fertiglobe has signed the engineering procurement and construction (EPC) contract with Tecnimont S.p.A.

Abu Dhabi, UAE – 14 February 2023: Fertiglobe (ADX: FERTIGLB), the strategic partnership between ADNOC and OCI, the world’s largest seaborne exporter of urea and ammonia combined, the largest nitrogen fertilizer producer in the Middle East and North Africa (“MENA”) region, and an early mover in clean ammonia, today reported that its full year 2022 revenue increased 52% to $5,028 million compared to 2021, while adjusted EBITDA was up 59% to $2,473 million, and adjusted net profit increased 75% to $1,287 million compared to $737 million in 2021. Q4 2022 revenues declined 11% to $1,054 million, while adjusted EBITDA was 27% lower YoY at

$472 million. Q4 2022 free cash flow was $413 million compared to $647 million in Q4 2021.

Ahmed El-Hoshy, CEO of Fertiglobe, commented:

“We are delighted to deliver solid results in our first year as a listed company with 52% revenue growth in 2022 and a 59% increase in adjusted EBITDA to $2,473 million. We continue to bear the fruits of our centralized commercial strategy and focus on delivering on our operational excellence program and our sustainability-focused projects and initiatives. We have successfully and safely completed several turnarounds across our plants in 2022, including in Q4 in the UAE and Egypt, and do not have further turnarounds planned at these facilities in 2023.

While the last few months have seen weaker nitrogen pricing globally, market fundamentals continue to remain healthy in the medium to longer term, underpinned by tight supply, healthy farm economics and decades-low grain stocks globally. There is significant pent-up demand for nitrogen fertilizers ahead of the application season, and affordability is boosted by the recent price declines. Moreover, there is no new greenfield urea supply starting up in 2023, and after that we see very few new additions until at least 2026. We expect demand upside for our industrial business, supportive of ammonia primarily, driven by a recovery in China, lower energy prices supporting global industrial demand, and an improving outlook for global growth.

We have a good order book going into the first quarter of 2023, and our disciplined commercial strategy and distribution capabilities allow us to manage inventories close to main demand centres, placing us well to serve key import markets. Also, as part of our commercial and sustainability efforts, we sent trial shipments of Diesel Exhaust Fuel (DEF / AdBlue®) from Egypt to Europe in Q4 2022 and early 2023, demonstrating our versatility and capacity to diversify our product offering, and expect to deliver more shipments over the course of 2023.

Our competitive position on the global cost curve due to our favourable costs structures and long-term gas supply agreements, as well as our free cash flow conversion capacity, continue to position us well to return capital to shareholders as we remain committed to our dividend policy of distributing excess free cash flow after providing for growth opportunities and maintaining investment grade parameters. We are pleased to announce H2 2022 dividends at $700 million, payable in April 2023, bringing the total for the full year 2022 to $1,450 million (including the $750 million H1 2022 dividend paid to shareholders in October 2022).

In 2022, we have continued to deliver on our hydrogen strategy while targeting investments significantly below replacement costs. We started the commissioning of the first phase of Egypt Green Hydrogen in Ain Sokhna during COP27 in November 2022. Once at full scale, the project will deliver up to c.15,000 tons of green hydrogen as feedstock for production of up to 90,000 tons of green ammonia per year in Fertiglobe’s existing ammonia plants. We are currently evaluating the engineering and technology choices for the full-scale 100 MW electrolyzer plant and pursuing financing and financial support instruments with the aim to reach Final Investment Decision (FID) on the facility in 2023. The project leverages our existing ammonia production and global distribution infrastructure, including OCI’s Port of Rotterdam ammonia import terminal, contributing to its delivery in record time. Receiving the ISCC Plus certification1 for renewable ammonia production from our Egypt facilities during Q4 2022 is an important milestone as it sets the stage for future exports and continued leadership in this space.

Fertiglobe made progress with the TA’ZIZ 1 million ton low-carbon ammonia project in the UAE, in partnership with GS Energy Corporation and Mitsui & Co., Ltd., announcing the signing of the Shareholders’ Agreement in January 2023, and signing the EPC contract with Tecnimont S.p.A on behalf of the project. The project will be financed by a mix of debt and equity.

As we progress tangible initiatives ahead of COP28 in the UAE, these projects allow us to demonstrate our commitment to taking concrete actions to meet the increasing demand for large-scale low-carbon hydrogen and ammonia and reduce the carbon footprint of both our operations and of hard-to-abate sectors in our value chain.

Finally, I would like to extend my thanks to the entire Fertiglobe team for delivering solid results in 2022 with a consistent focus on safety, performance and excellence.”

1 The certification provides an independent accreditation of bio-circular raw materials such as biomethane or green / bio-based ammonia used in the production process. As a globally applicable sustainability certification system, ISCC covers all sustainable feedstocks, including agricultural and forestry biomass, biogenic wastes, circular materials and renewables. Agricultural feedstocks that are certified to the ISCC standard must comply with various sustainability criteria to protect forests and other wooded land, high-carbon stock lands and highly biodiverse grassland.

Markets

Fertiglobe believes the outlook for nitrogen market continues to be supported by crop fundamentals and tight supply dynamics

- Nitrogen demand is expected to recover to support rebuilding of global grain stocks:

- Global grain stock-to-use ratios are at the lowest levels in 20 years, and it will likely take at least until 2025 to replenish stocks.

- Forward grain prices (US corn futures >$5 / bushel to the end of 2025, compared to $3.7 / bushel in 2015 – 2019) support farm incomes and should incentivize increased planted acreage and nitrogen

demand to help rebuild these grain stocks.

- As a result, global demand is expected to be above trend levels at least until 2025 driven by:

- Expected increase in the US alone of 4 million corn acres to an estimated 93 million acres in 2023 compared to 2022, when the season was impacted by weather.

- Higher demand in 2023 from major importing countries with focus on food security.

- The recent decline in nitrogen pricing is supportive of improving affordability and demand.

- China recovery and lower energy prices supporting recovery of industrial demand, particularly for ammonia.

- Nitrogen supply is expected to be tighter over 2023 – 2027:

- Industry consultants expect no new major greenfield urea supply to come online in 2023, limited additions to 2026, and new Russian supply is still delayed.

- The ammonia market is also tight, with merchant demand exceeding supply in 2023 – 2026 compared to a net surplus in 2015 – 2019.

- Good visibility on the supply outlook given long lead times of four to five years to build new plants and replacement costs have risen materially due to inflationary pressures.

- Chinese urea exports in 2022 were 47% lower year-over-year and are expected to remain low over the medium term, with export controls in place until H2 2023 to prioritize domestic demand.

- Feedstock pricing is expected to remain volatile in the short-term given weather and regulatory intervention, but is expected to remain well above historical averages:

- 2023-25 forward European gas prices are c.$17/mmBtu (c.3x higher than 2015-19).

Dividends and capital structure

Fertiglobe’s dividend policy is to substantially pay out all excess free cash flows after providing for growth opportunities, while maintaining investment grade credit ratings (S&P: BBB-, Moody’s: Baa3, Fitch: BBB-; all with stable outlooks). Management announced H2 2022 dividends in line with previous guidance, at $700 million or the equivalent of AED 0.31 per share, payable in April 2023. During calendar year 2022, Fertiglobe paid cash dividends of $1.1 billion.

Strong earnings and cash generation during the year resulted in a net cash position of $287 million as of 31 December 2022 (0.1x net cash / adjusted EBITDA), compared to net debt of $487 million as at 31 December 2021 (0.3x net debt / adjusted EBITDA), supporting future growth opportunities and an attractive dividend pay-out.

On 22 December 2022, Fertiglobe refinanced its existing bridge loan facility with a new three-year facility amounting to $300 million, with a margin of 1.5% and a new five-year facility amounting to $600 million, with a margin of 1.75%, extending Fertiglobe’s weighted average debt maturity from 1.3 years to 4.3 years. In addition, the company increased the capacity of its existing Revolving Credit Facility (RCF) by $300 million to $600 million, and extended the maturity to December 2027 (from August 2026), providing ample liquidity.

Consolidated Financial Results at a Glance

Financial Highlights ($ million, unless otherwise stated)

Operational Highlights

Highlights:

- 12-month rolling recordable incident rate to 31 December 2022 of 0.27 incidents per 200,000 manhours.

- Fertiglobe’s Q4 2022 performance was impacted by lower urea selling prices compared to both Q4 2021 and Q3 2022, largely as a result of a drop in European gas prices combined with a delay in demand during the seasonally slow winter months.

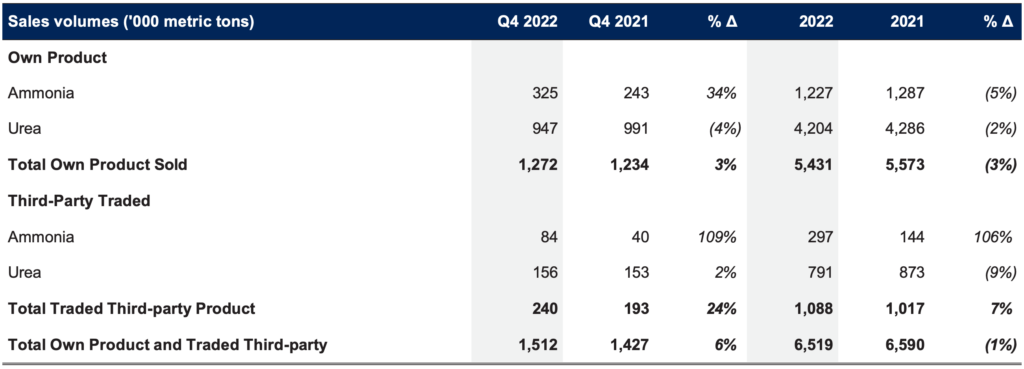

- Fertiglobe’s total own-produced sales volumes were up 3% to 1,272kt in Q4 2022 vs Q4 2021, driven by:

- A 34% increase in ammonia own-produced sales volumes to 325kt from 243kt in Q4 2021

- Partially offset by a 4% decrease in urea own-produced sales volumes to 947kt YoY compared to 991kt in Q4 2021 mainly due to turnarounds

- Traded third party volumes increased 24% YoY to 240kt in Q4 2022, compared to 193kt in Q4 2021.

- Total own-produced and traded third party volumes of 1,512kt were 6% higher in Q4 2022, compared to Q4 2021.

- In 2022, Fertiglobe’s total own-produced sales volumes were down 3% to 5,431kt compared to 2021, driven by:

- 5% decrease in ammonia own-produced sales volumes to 1,227kt from 1,287kt in 2021, and

- A 2% decrease in urea own-produced sales volumes to 4,204kt from 4,286kt in 2021

- Traded third party volumes were up 7% YoY at 1,088kt in 2022 compared to 1,017kt in 2021

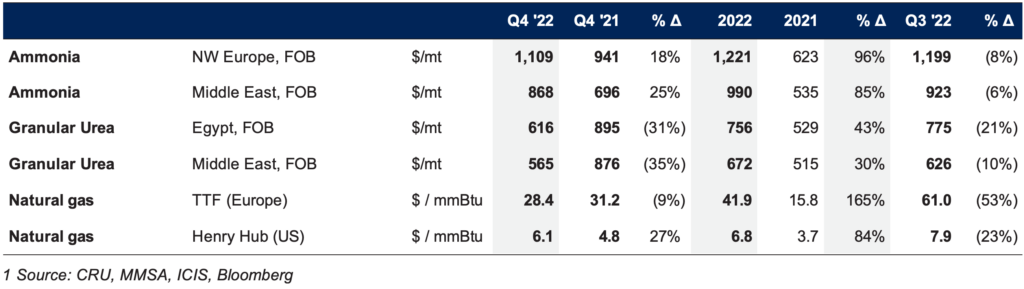

- Middle East ammonia benchmark prices were up 25% in Q4 2022, while Egypt urea benchmark prices were down 31% compared to the same period in 2021 (-6% and -21% compared to Q3 2022).

Product sales volumes

Benchmark prices1

Operational Performance

Total own-produced sales volumes were up 3% during the fourth quarter of 2022 to 1,272kt compared to the same period last year.

Ammonia prices were higher than the prices seen in Q4 2021, with ammonia Middle East benchmark up 25% YoY, while the urea Egypt benchmark price was down 31%. Compared to Q3 2022, the ammonia Middle East benchmark was down 6%, while the urea Egypt benchmark price was down 21%.

The lower urea selling prices during the quarter resulted in a 11% YoY decrease in revenues to $1,054 million in Q4 2022. This translated into a 27% decline in adjusted EBITDA to $472 million in Q4 2022 from $648 million in Q4 2021. As a result, Fertiglobe’s adjusted EBITDA margin dropped to 44.8% in Q4 2022 from 54.7% in Q4 2021.

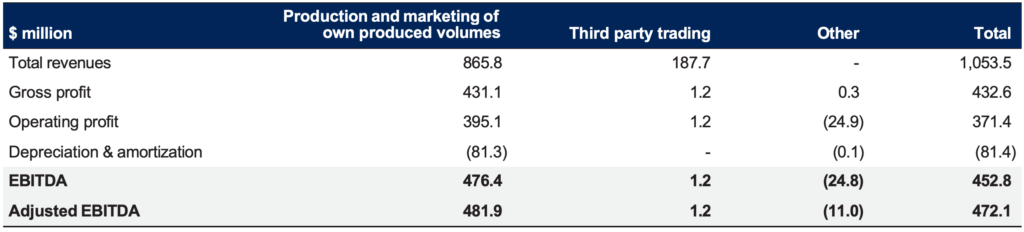

Segment overview Q4 2022

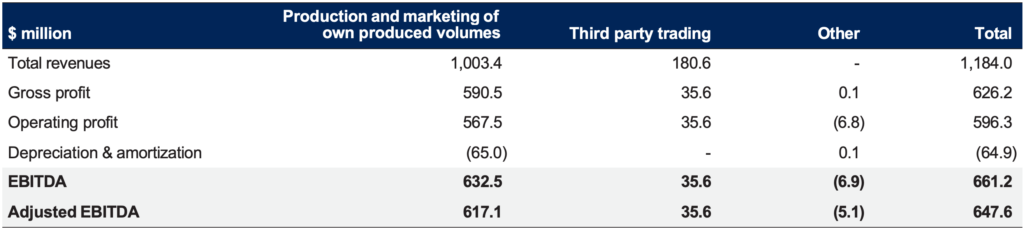

Segment overview Q4 2021

Segment overview 2022

Segment overview 2021

Financial Highlights

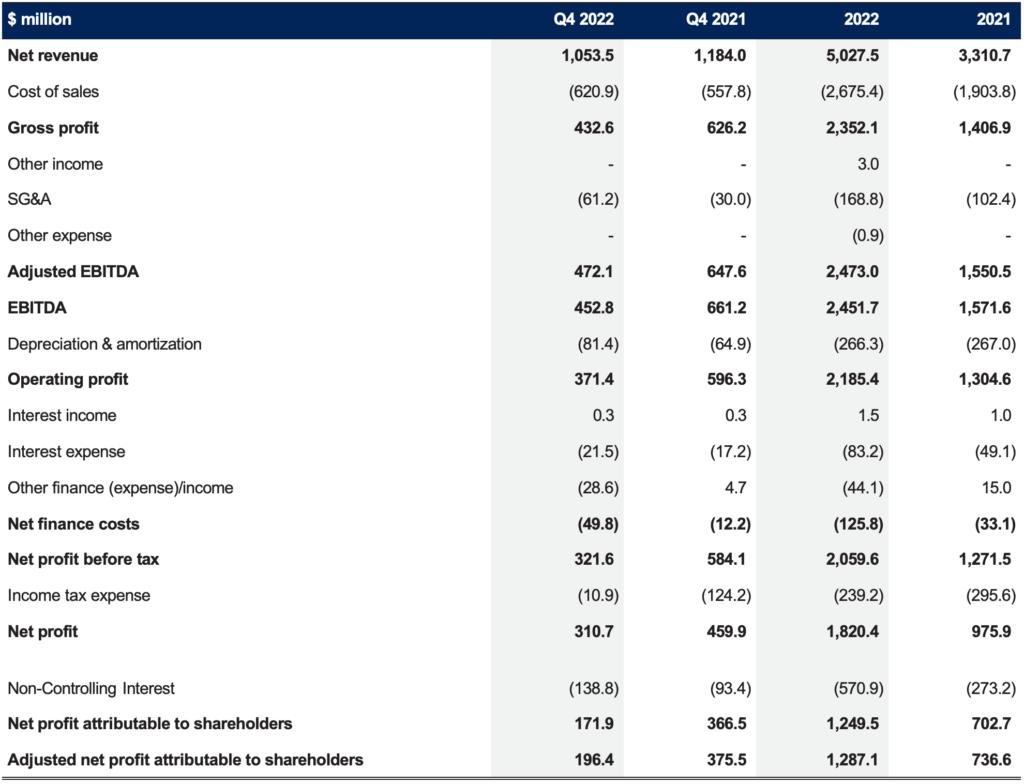

Summary results

Consolidated revenue decreased by 11% to $1,054 million in the fourth quarter of 2022 compared to the same quarter in 2021, driven by lower urea selling prices.

Adjusted EBITDA declined 27% YoY to $472 million in Q4 2022 compared to $648 million in Q4 2021.

Q4 2022 adjusted net profit was $196 million compared to an adjusted net profit of $376 million in Q4 2021. Reported net profit attributable to shareholders was $172 million in Q4 2022 compared to a net profit attributable to shareholders of $367 million in Q4 2021.

Consolidated statement of income

Reconciliation to Alternative Performance Measures

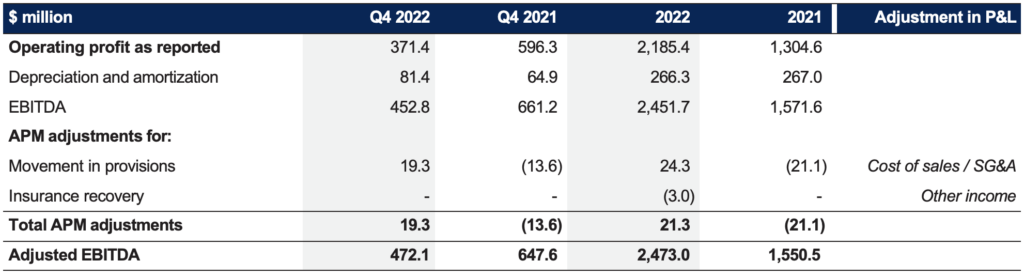

Adjusted EBITDA

Adjusted EBITDA is an Alternative Performance Measure (APM) that intends to give a clear reflection of underlying performance of Fertiglobe’s operations. The main APM adjustments at EBITDA level relate to the movement in provisions and insurance recovery.

Reconciliation of reported operating income to adjusted EBITDA

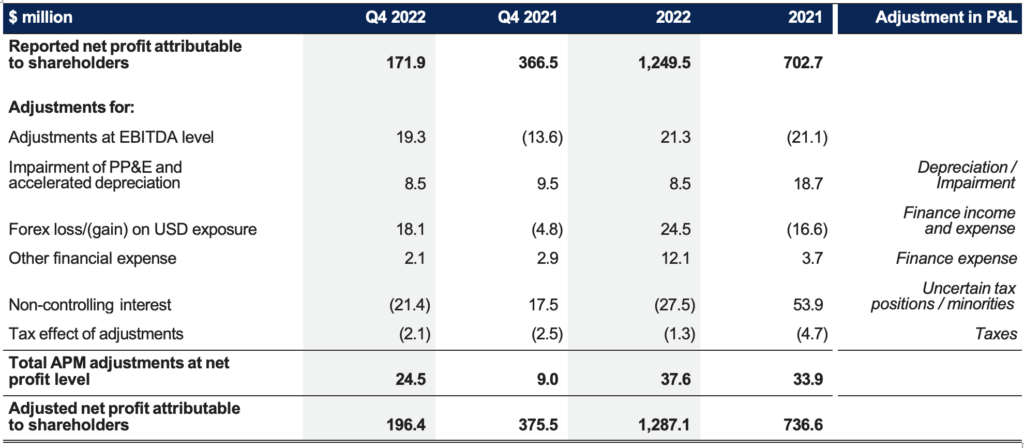

Adjusted net profit attributable to shareholders

At the net profit level, the main APM adjustments relate to the impact on non-cash foreign exchange gains and losses on USD exposure, impairment of PP&E and accelerated depreciation and other financial expense.

Reconciliation of reported net profit to adjusted net profit

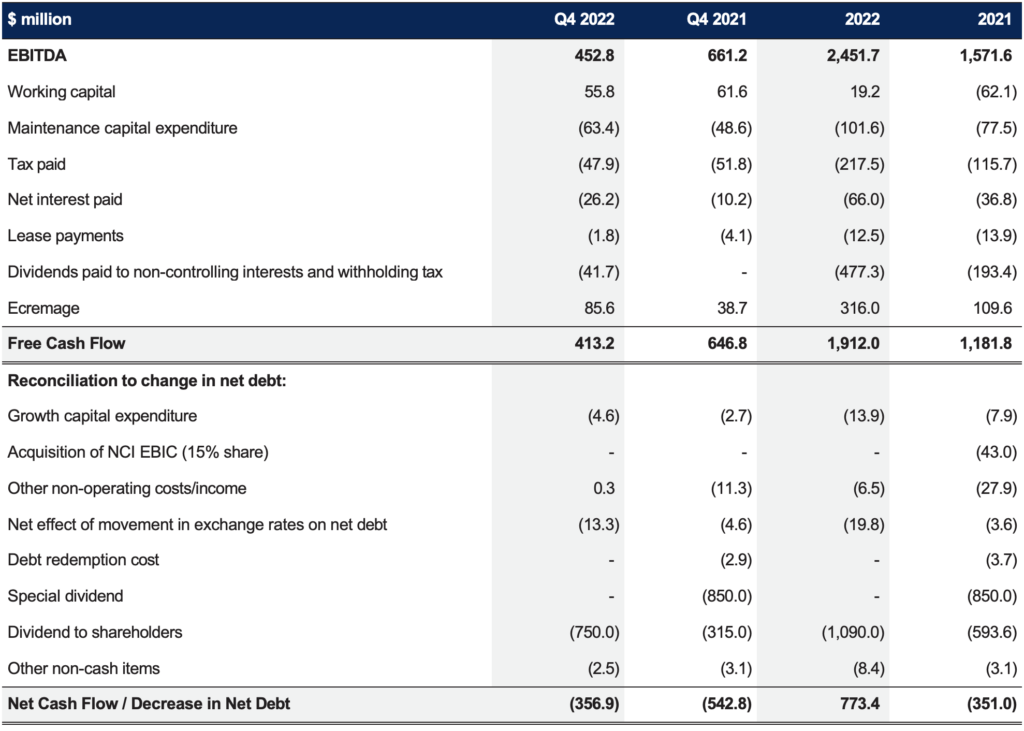

Free Cash Flow and Net Debt

Free cash flow before growth capex amounted to $413 million during Q4 2022, compared to $647 million during the same period last year, reflecting performance for the quarter and working capital inflows offset by dividends paid to non-controlling interests and taxes.

Total cash capital expenditures including growth capex were $68 million in Q4 2022 compared to $51 million in Q4 2021. 2022 cash capital expenditures (excluding growth capital expenditure) were $102 million, below management’s guidance range of $120-140 million due to some deferrals into 2023. For 2023, management guides for capital expenditures (excluding growth capital expenditure) of $100-130 million.

Reconciliation of EBITDA to Free Cash Flow and Change in Net Debt

Investor and Analyst Conference Call

On 14 February 2023 at 4:30 PM UAE (12:30 AM London, 7:30 AM New York), Fertiglobe will host a conference call for investors and analysts. To access the call please dial:

Passcode: 260339

About Fertiglobe

Fertiglobe is the world’s largest seaborne exporter of urea and ammonia combined, and an early mover in sustainable ammonia. Fertiglobe’s production capacity comprises of 6.6 million tons of urea and merchant ammonia, produced at four subsidiaries in the UAE, Egypt and Algeria, making it the largest producer of nitrogen fertilizers in the Middle East and North Africa (MENA), and benefits from direct access to six key ports and distribution hubs on the Mediterranean Sea, Red Sea, and the Arab Gulf. Headquartered in Abu Dhabi and incorporated in Abu Dhabi Global Market (ADGM), Fertiglobe employs more than 2,700 employees and was formed as a strategic partnership between OCI Global (“OCI”) and ADNOC. Fertiglobe is listed on the Abu Dhabi Securities Exchange (“ADX”) under the symbol “FERTIGLB” and ISIN “AEF000901015. To find out more, visit: fertiglobe.com.

For additional information, contact:

Fertiglobe Investor Relations

Rita Guindy, Director

Emails:

For additional information on Fertiglobe: fertiglobe.com