Financial and Outlook

- Fertiglobe reported Q1 2023 revenues and adjusted EBITDA at $694 million and $297 million, respectively. Adjusted net profit was $135 million in Q1 2023, and the company generated free cash flow of $271 million in Q1 2023.

- Fertiglobe delivered 9% higher own-produced sales volumes in Q1 2023 compared to Q1 2022, supported by a disciplined commercial strategy and centralized distribution capabilities.

- Fertiglobe is well positioned to balance dividend payments while selectively pursuing value-creative growth opportunities below replacement cost, supported by its balance sheet (net cash: $564 million as of 31 March 2023).

- Fertiglobe’s management guides for H1 2023 dividends of at least $250 million, payable in October 2023. The final dividend amount will be announced with Q2 2023 results in August 2023.

- In addition to its manufacturing improvement plan, Fertiglobe has recently launched a cost optimization initiative targeting an annualized run-rate of $50 million in savings to reinforce its first quartile cost positioning, planned to be achieved over the next 12 – 18 months. In addition, the recent devaluation of the Egyptian pound is expected to have a positive impact on the company’s cost base.

- Market Outlook: Nitrogen prices declined as result of energy price volatility, short term buying patterns and ramp-up of new supply commissioned in 2022, but markets have begun to tighten into the second quarter and prices started to improve in some regions. Decades low grain stocks and high farmer profitability continue to support a demand recovery with limited new supply from 2023 onwards.

Corporate Updates

- Fertiglobe produced on-spec green ammonia at its Egypt facilities in Q1 2023, following the start of commissioning of Egypt Green Hydrogen in November 2022. The Final Investment Decision (FID) on the full-scale 100MW plant is targeted during 2023.

Abu Dhabi, UAE – 09 May 2023: Fertiglobe (ADX: FERTIGLB), the strategic partnership between ADNOC and OCI Global, the world’s largest seaborne exporter of urea and ammonia combined, the largest nitrogen fertilizer producer in the Middle East and North Africa (“MENA”) region, and an early mover in sustainable ammonia, today reported Q1 2023 revenue of $694 million, adjusted EBITDA of $297 million, adjusted net profit of $135 million, and free cash flow of $271 million. This is driven by lower selling prices during the quarter on continued declines in European gas prices and demand delays in several key regions, primarily due to weather conditions, as well as the deferral of 100kt in urea shipments to Ethiopia, with an estimated EBITDA impact of $35 million.

Ahmed El-Hoshy, CEO of Fertiglobe, commented:

“The nitrogen outlook remains favorable in the medium to longer term. New supply that commisioned in 2022, has been absorbed by the market, and limited major greenfield supply additions are expected in the next four years. Agricultural demand is buoyed by attractive farmer economics, incentivizing nitrogen fertilizer application to replenish decade-low grain stocks. European gas futures over next winter and 2024 are pricing in expectations of a tighter market than current levels, implying ammonia cost support of ~$815/t (including CO2) and ~$650/t (excluding CO2). This should result in closures of European marginal production if pricing remains below cost for a sustained period.

Natural gas prices declined sharply in Q1 2023 due to a mild winter and resulted in lower marginal costs in Europe, causing deferred buying in several key regions. This, combined with relatively muted industrial demand, led to selling prices well below their levels in the same period last year, impacting our earnings growth in Q1 2023 on a year on year basis. In Q1 2023, we have delivered revenues of $694 million, adjusted EBITDA of $297 million, and free cash flow of $271 million, below Q1 2022 levels of $1,185 million, $625 million, and $521 million, respectively.

I am pleased to report that despite slower price momentum in Q1 2023 and a deferral of two 50kt urea shipments to Ethiopia at a weighted average price of $700/t, our team was able to deliver 9% higher own-produced sales volumes during the quarter. This is driven by our disciplined commercial strategy and centralized distribution capabilities, targeting demand centres that offer attractive netbacks. We continue to have a strong order book for the coming months.

In line with our continued commitment to creating and returning shareholder value, we are pleased to announce our guidance for H1 2023 dividends at a minimum of $250 million or the equivalent of at least AED 11 fils per share, payable in October 2023, with the exact amount to be disclosed with Q2 2023 results in August 2023.

We are progressing several initiatives to further support free cash generation, including our manufacturing improvement plan announced last year, which is on track to deliver operational and EBITDA efficiencies over the next 2-3 years. In addition, we also recently launched an initiative to further optimize Fertiglobe’s cost structure, targeting $50 million in annualized savings, aimed to reinforce our top quartile cash cost positioning, and we expect to achieve these savings over the next 12 – 18 months. In addition, we expect a positive impact from the recent devaluation of the Egyptian pound on our cost base.

Following the commissioning of the first phase of Egypt Green Hydrogen in Ain Sokhna during COP27 in Q4 2022, we are excited to announce the production of on-spec green ammonia at our facilities in Egypt during the quarter. We expect volumes to ramp up over the year, and target 2023 FID on the full scale 100MW electrolyzer plant, planned to produce up to c.15,000 tons of green hydrogen as feedstock for production of up to 90,000 tons of green ammonia per year in Fertiglobe’s existing ammonia plants.

With these projects and initiatives, we reiterate our commitment to delivering on our sustainability agenda, and to showing serious progress towards a more sustainable production footprint for ourselves, while contributing to the decarbonization of other industries in our value chain, including power and transport.

I am grateful to the Fertiglobe team for a continued focus on safety, performance and excellence and look forward to our journey towards a more sustainable future for our industry and for others.”

Markets

- Fertiglobe believes the outlook for nitrogen markets continues to be supported by crop fundamentals and tight supply dynamics in the medium term

- Nitrogen demand is expected to recover to support rebuilding of global grain stocks:

- Global grain stock-to-use ratios remain at the lowest levels in 20 years, and it will likely take at least until 2025 to replenish stocks.

- Forward grain prices (US corn futures >$5 / bushel to the end of 2025, compared to $3.7 / bushel from 2015 – 2019) support farm incomes and incentivize nitrogen demand to be above historical trend levels.

- The recent decline in nitrogen pricing is supportive of improving affordability and demand.

- Nitrogen supply is expected to be tighter over 2023 – 2027:

- In 2022, six million tons of new urea capacity commissioned, with some plants ramping up in 2023. Industry consultants expect no new major greenfield urea supply in 2023 and limited additions to 2027.

- Chinese urea exports are expected to remain low over the medium term in the range of 3 – 4 mtpa.

- Feedstock pricing is expected to remain well above historical averages:

- 2023 – 2025 forward European gas prices are c.$16/mmBtu (c.3x higher than 2015-2019), with higher prices anticipated for next winter

- The gas forwards imply marginal cost support levels for ammonia of c.$815/ton including CO2 for next winter and 2024, which should result in closures of European marginal production if pricing remains below cost for a sustained period of time.

Dividends and capital structure

On 22 December 2022, Fertiglobe refinanced its existing bridge loan facility with a new three-year facility amounting to $300 million, with a margin of 1.5% and a new five-year facility amounting to $600 million, with a margin of 1.75%, extending Fertiglobe’s weighted average debt maturity from 2 years to 4 years. In addition, the company increased the capacity of its existing Revolving Credit Facility (RCF) by $300 million to reach $600 million, and extended the maturity to December 2027 (from August 2026), providing ample liquidity.

As at the end of March 2023, Fertiglobe reported a net cash position of $564 million (0.3x net cash / adjusted LTM EBITDA), compared to net cash of $287 million as at 31 December 2022 (0.1x net cash / adjusted LTM EBITDA), supporting future growth opportunities as well as dividend pay-out.

Fertiglobe remains committed to its dividend policy to substantially pay out all excess free cash flows after providing for growth opportunities, while maintaining investment grade credit ratings (S&P: BBB-, Moody’s: Baa3, Fitch: BBB-; all with stable outlooks). Fertiglobe paid a total of $1,450 million in cash dividends for 2022, including H1 2022 dividends of $750 million paid in October 2022, and H2 2022 dividends of $700 million paid in April 2023. Management guides for H1 2023 dividends of at least $250 million or the equivalent of at least AED 11 fils per share, payable in October 2023.

Consolidated Financial Results at a Glance

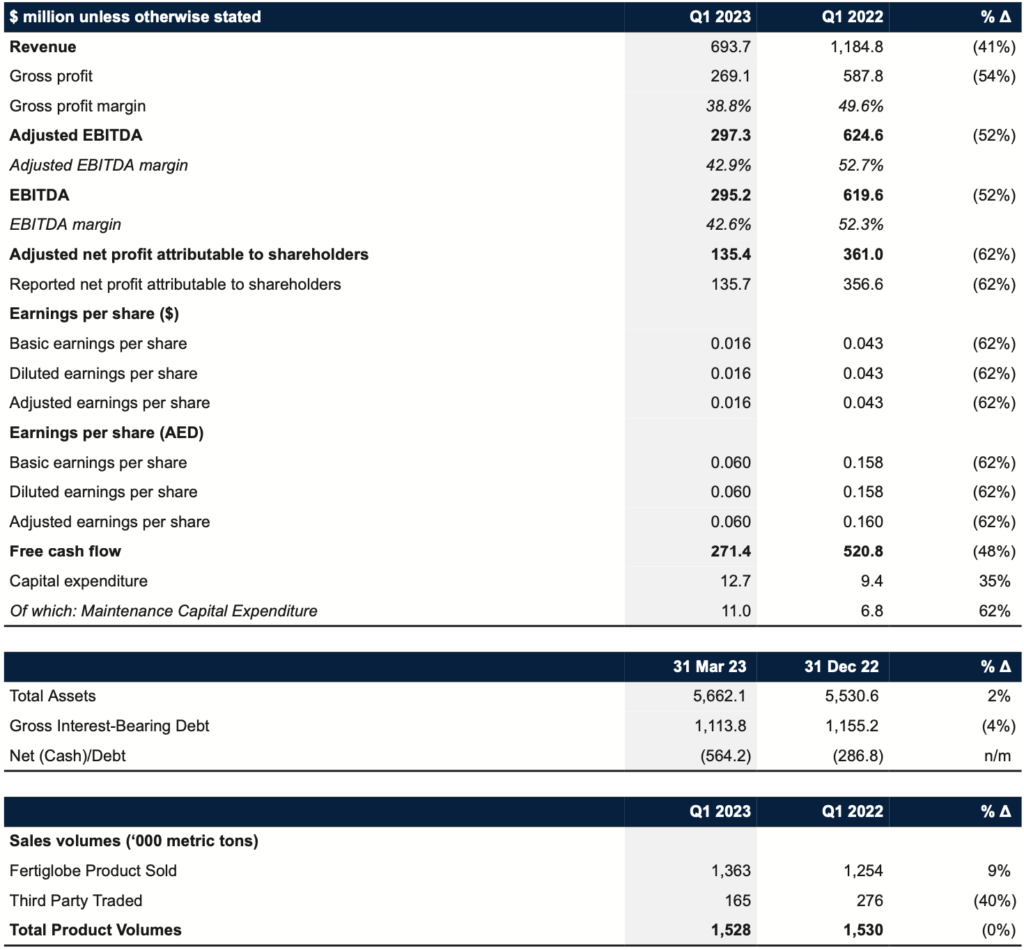

Financial Highlights ($ million, unless otherwise stated)

Operational Highlights

Highlights:

- 12-month rolling recordable incident rate to 31 March 2023 of 0.24 incidents per 200,000 manhours.

- Fertiglobe’s Q1 2023 performance was impacted by lower selling prices compared to peak pricing in the same period last year, mainly on lower European gas prices combined with demand delays in several key regions.

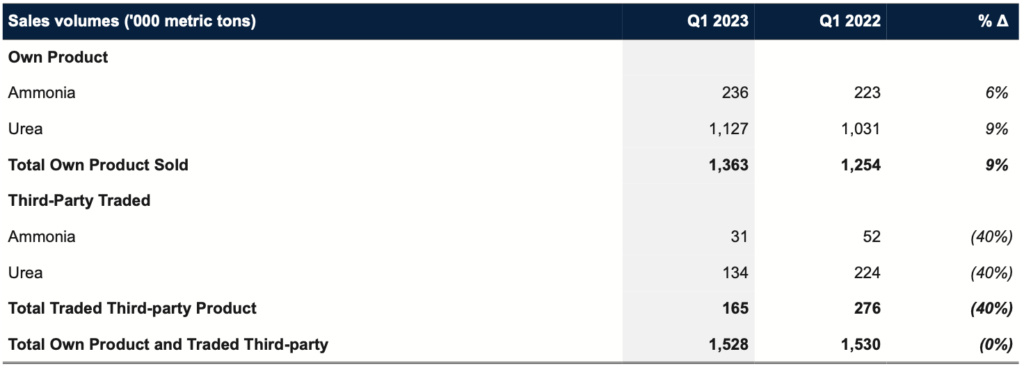

- Fertiglobe’s total own-produced sales volumes were up 9% to 1,363kt in Q1 2023 vs Q1 2022, driven by:

- A 6% increase in ammonia own-produced sales volumes to 236kt from 223kt in Q1 2022

- A 9% increase in urea own-produced sales volumes to 1,127kt YoY compared to 1,031kt in Q1 2022

- Traded third party volumes decreased 40% YoY to 165kt in Q1 2023, compared to 276kt in Q1 2022.

- Total own-produced and traded third party volumes of 1,528kt were largely unchanged in Q1 2023 compared to Q1 2022.

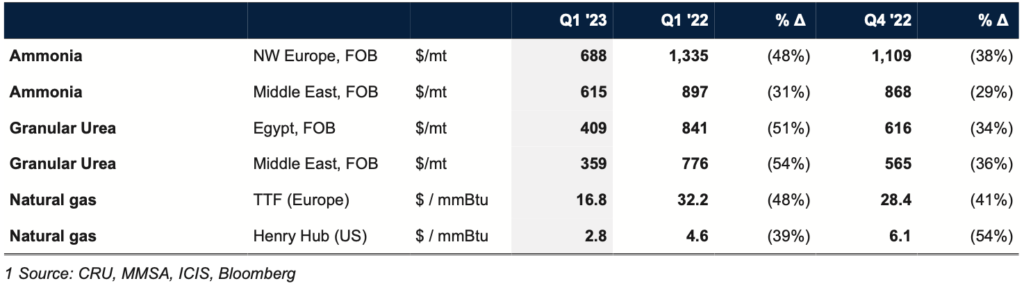

- Middle East ammonia benchmark prices were down 31% in Q1 2023, while Egypt urea benchmark prices were down 51% compared to the same period in 2022 (29% and 34% lower compared to Q4 2022).

Product sales volumes

Benchmark prices1

Operational Performance

Total own-produced sales volumes were up 9% during the first quarter of 2023 to 1,363kt compared to the same period last year.

Ammonia prices were well below peak prices in Q1 2022, with ammonia Middle East benchmark down 31% YoY, while the urea Egypt benchmark price was down 51%. Compared to Q4 2022, the ammonia Middle East benchmark was down 29%, while the urea Egypt benchmark price was down 34%.

The lower selling prices during the quarter resulted in a 41% YoY decrease in revenues to $694 million in Q1 2023. This translated into a 52% decline in adjusted EBITDA to $297 million in Q1 2023 from $625 million in Q1 2022. As a result, Fertiglobe’s adjusted EBITDA margin dropped to 43% in Q1 2023 from 53% in Q1 2022.

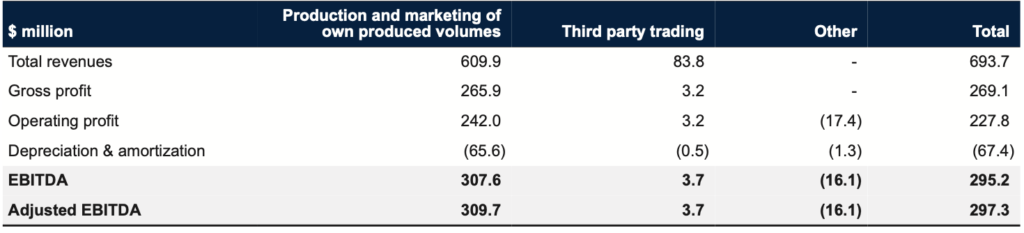

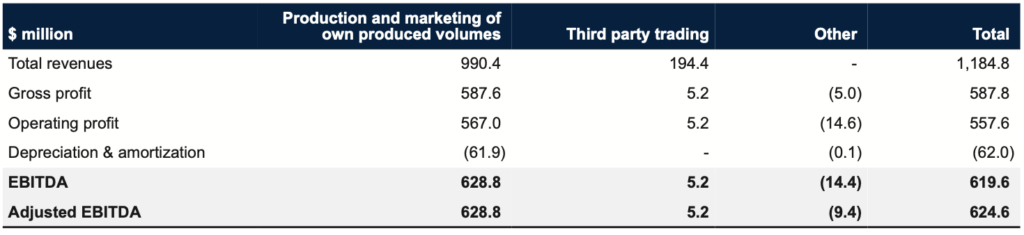

Segment overview Q1 2023

Segment overview Q1 2022

Financial Highlights

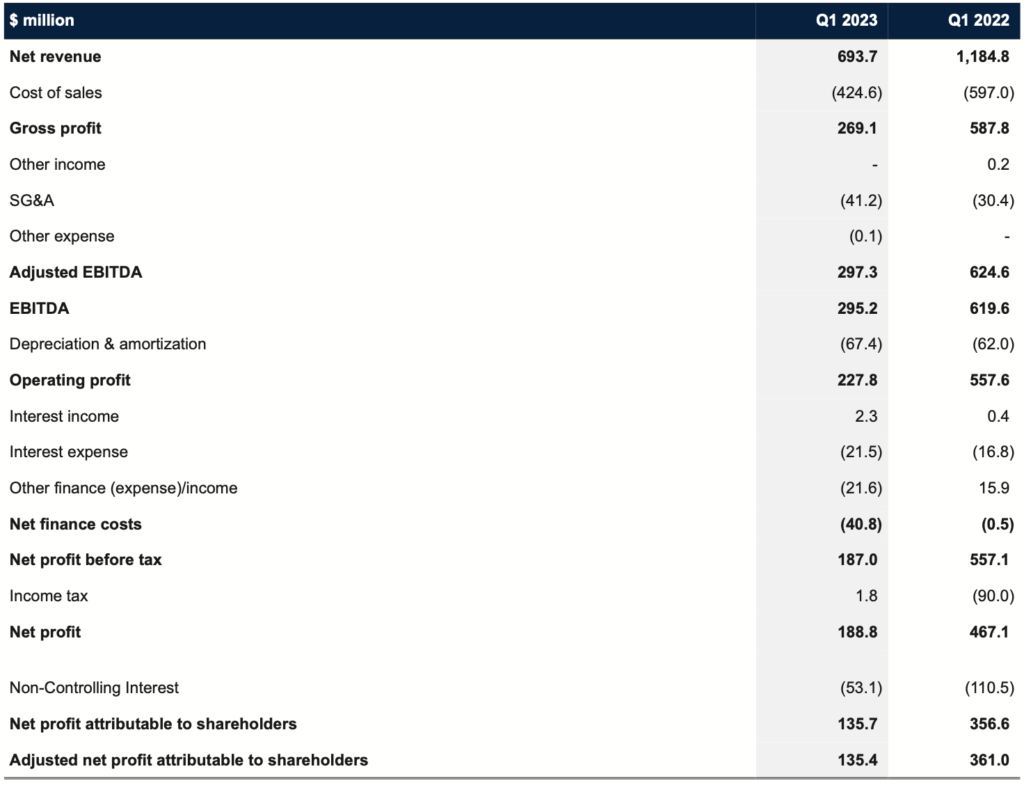

Summary results

Consolidated revenue decreased by 41% to $694 million in the first quarter of 2023 compared to the same quarter in 2022, driven by lower urea selling prices.

Adjusted EBITDA declined by 52% YoY to $297 million in Q1 2023 compared to $625 million in Q1 2022.

Q1 2023 adjusted net profit was $135 million compared to an adjusted net profit of $361 million in Q1 2022. Reported net profit attributable to shareholders was $136 million in Q1 2023 compared to a net profit attributable to shareholders of $357 million in Q1 2022.

Consolidated statement of income

Reconciliation to Alternative Performance Measures

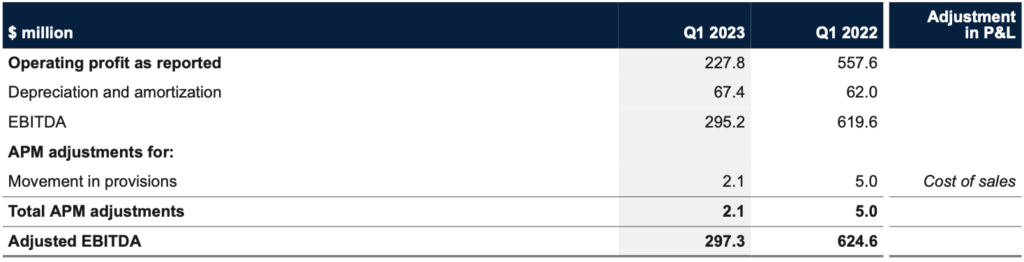

Adjusted EBITDA

Adjusted EBITDA is an Alternative Performance Measure (APM) that intends to give a clear reflection of underlying performance of Fertiglobe’s operations. The main APM adjustments at EBITDA level relate to the movement in provisions during the quarter

Reconciliation of reported operating income to adjusted EBITDA

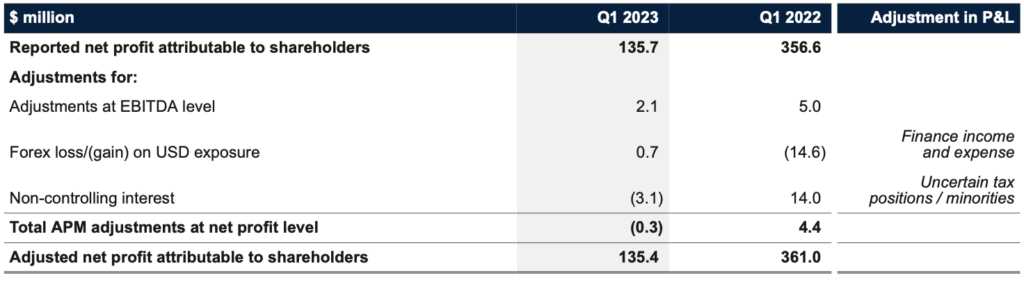

Adjusted net profit attributable to shareholders

At the net profit level, the main APM adjustments relate to the impact on non-cash foreign exchange gains and losses on USD exposure as well as non-controlling interest

Reconciliation of reported net profit to adjusted net profit

Free Cash Flow and Net Cash

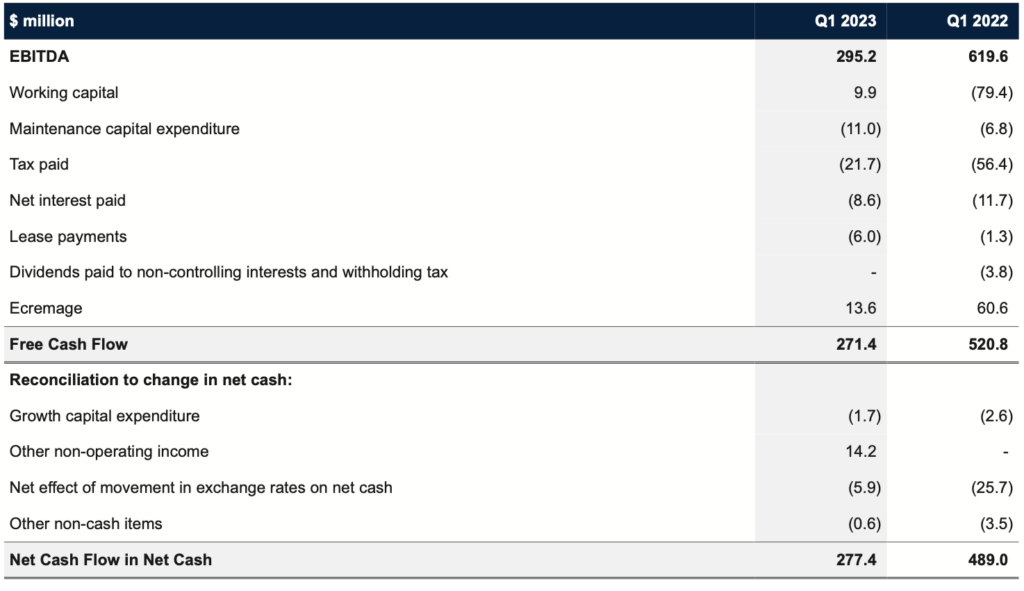

Free cash flow before growth capex amounted to $271 million during Q1 2023, compared to $521 million during the same period last year, reflecting performance for the quarter and working capital inflows offset by tax, interest and lease payments.

Total cash capital expenditures including growth capex were $13 million in Q1 2023 compared to $9 million in Q1 2022, of which $11 million was related to maintenance capital expenditures. For 2023, management maintains its guidance for capital expenditures (excluding growth capital expenditure) of $100-130 million.

Reconciliation of EBITDA to Free Cash Flow and Change in Net Cash

Investor and Analyst Conference Call

On 9 May 2023 at 3:30 PM UAE (12:30 PM London, 9:30 AM New York), Fertiglobe will host a conference call for investors and analysts. To access the call please dial:

Passcode: 845998

About Fertiglobe

Fertiglobe is the world’s largest seaborne exporter of urea and ammonia combined, and an early mover in sustainable ammonia. Fertiglobe’s production capacity comprises of 6.6 million tons of urea and merchant ammonia, produced at four subsidiaries in the UAE, Egypt and Algeria, making it the largest producer of nitrogen fertilizers in the Middle East and North Africa (MENA), and benefits from direct access to six key ports and distribution hubs on the Mediterranean Sea, Red Sea, and the Arab Gulf. Headquartered in Abu Dhabi and incorporated in Abu Dhabi Global Market (ADGM), Fertiglobe employs more than 2,700 employees and was formed as a strategic partnership between OCI Global (“OCI”) and ADNOC. Fertiglobe is listed on the Abu Dhabi Securities Exchange (“ADX”) under the symbol “FERTIGLB” and ISIN “AEF000901015. To find out more, visit: fertiglobe.com.

For additional information, contact:

Fertiglobe Investor Relations

Rita Guindy, Director

Emails:

For additional information on Fertiglobe: fertiglobe.com