Highlights:

Financial and Outlook

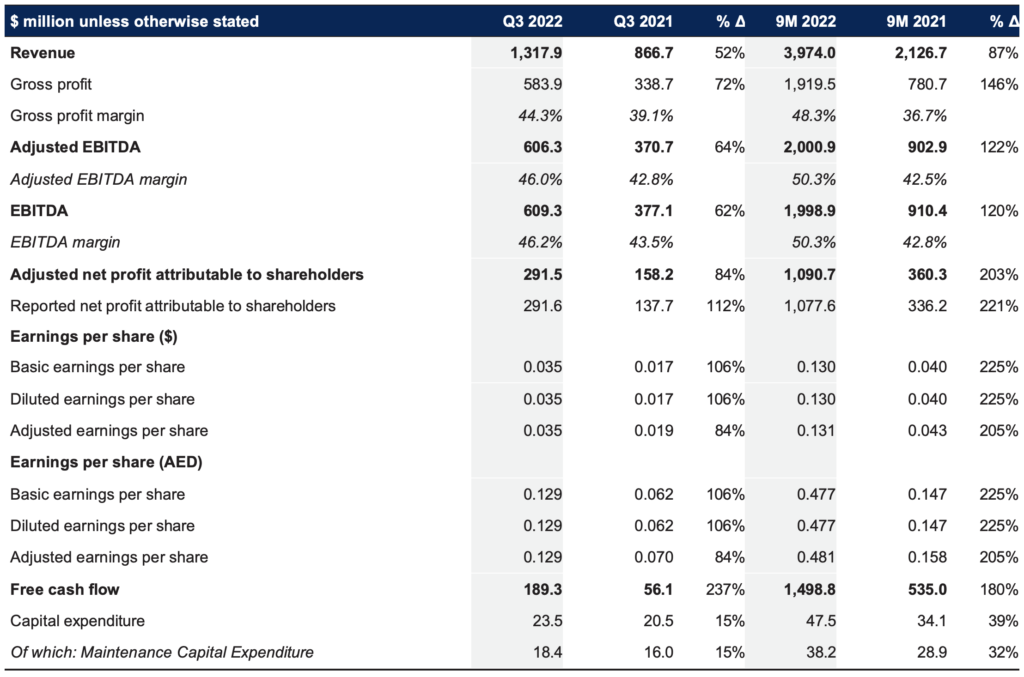

- Q3 2022 revenues increased 52% YoY to $1,318 million and adjusted EBITDA +64% YoY to $606 million, driven by higher selling prices.

- Adjusted net profit was $292 million in Q3 2022, an increase of 84% compared to $158 million in Q3 2021.

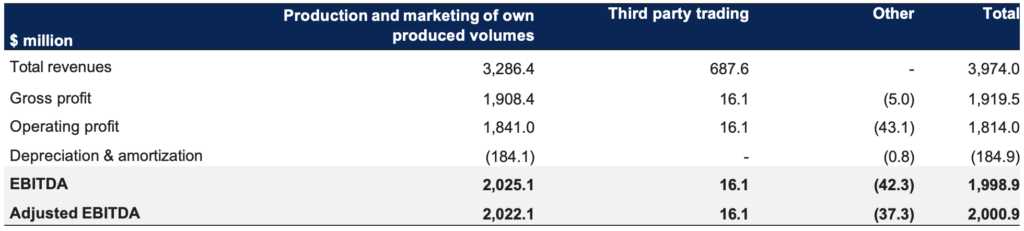

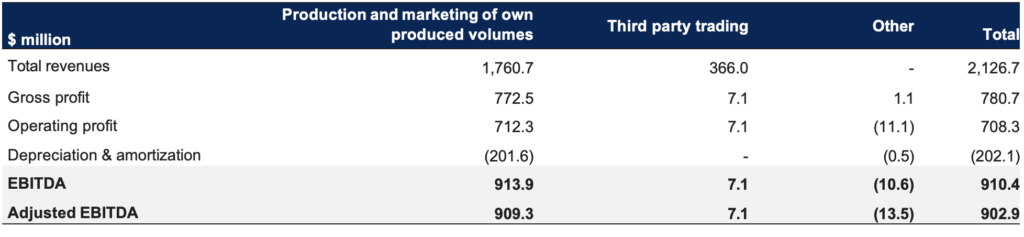

- 9M 2022 revenues increased 87% to $3,974 million YoY, adjusted EBITDA was up 122% to $2,001 million, and adjusted net profit increased 203% to $1,091 million compared to $360 million in 9M 2021.

- Fertiglobe generated free cash flow of $189 million in Q3 2022, after distributions to minorities of $368 million, a 237% increase versus the same period last year, and $1,499 million in 9M 2022 versus $535 million in 9M 2021.

- Our consolidated leverage position (net cash: $644 million as of 30 September 2022) supports potential growth opportunities as well as attractive dividend payout.

- Management guides for H2 2022 dividends at a minimum of $700 million or the equivalent of AED 0.31 per share, payable in April 2023. Fertiglobe’s attractive dividend outlook is backed by its competitive position on the global cost curve and free cash flow conversion capacity.

Abu Dhabi, UAE – 3 November 2022: Fertiglobe (ADX: FERTIGLB), the strategic partnership between ADNOC and OCI, the world’s largest seaborne exporter of urea and ammonia combined, the largest nitrogen fertilizer producer in the Middle East and North Africa (“MENA”) region, and an early mover in clean ammonia, today reported that its Q3 2022 revenues increased 52% to $1,318 million, while adjusted EBITDA grew 64% to $606 million compared to Q3 2021. Free cash flow increased to $189 million in Q3 2022 from $56 million in Q3 2021.

Ahmed El-Hoshy, CEO of Fertiglobe commented:

“We are pleased to report yet another solid set of results in Q3 2022, driven by a step-up in urea and ammonia prices compared to the same period last year, supported by tight market balances, outweighing the typical seasonal slowdown in Q3. Looking ahead, our order book in Bangladesh, Australia, and Europe is robust, as demand picks up ahead of spring application in key import markets, giving us good visibility for Q4 and the upcoming season in H1 2023. This, coupled with Fertiglobe’s competitive position on the global cost curve and free cash flow conversion capacity, implies that we are well-placed to continue to return capital to shareholders, and expect H2 2022 dividends to be a minimum of $700 million, bringing the total for the full year 2022 to a minimum of $1.45 billion, including the $750 million H1 2022 dividend paid to shareholders in October 2022.

The outlook for the fundamentals of our nitrogen end markets continues to be underpinned by tight supply, healthy farm economics and decades low grain stocks globally, all of which incentivize the use of nitrogen fertilizers. Forward curves continue to imply that natural gas prices in Europe are expected to remain tight, and at elevated levels through at least 2024, setting ammonia and urea breakeven pricing well above historical averages.

At Fertiglobe, our operational excellence program continues to be at the forefront of our agenda with a sharpened focus on utilizing our young, world-scale production assets efficiently and capturing the highest netbacks as we capitalize on global supply chains – in partnership with OCI. Building on our position as a leading producer and the largest seaborne exporter globally of essential nitrogen fertilizer products, we aim to fill supply gaps where possible and help in addressing global food security concerns.

We also continue to make progress with our low-/no-carbon ammonia project pipeline, including the demonstration plant in Egypt as a proof of concept for green hydrogen to green ammonia. We look to deliver on our hydrogen strategy while targeting investments significantly below replacement costs and setting the stage for the leading role we aspire to play in decarbonizing industries that make up in excess of 90% of current global greenhouse gas emissions.

As always, I would like to express my gratitude to the Fertiglobe team for working hard to deliver on our strategy and for always putting safety first.”

Markets

Nitrogen outlook supported by crop fundamentals and tight supply dynamics

Prices are supported by several market factors which suggest a structural shift to a multi-year demand driven environment.

- Crop fundamentals have strengthened further, supportive of nitrogen demand to increase grain stocks:

- Global grain stock-to-use ratios are at the lowest levels since 2011/12 and it will likely take at least until 2024 to replenish stocks.

- Disruptions to agricultural supply chains with droughts in the Northern Hemisphere are extending the tightness in the agricultural cycle, and supportive of demand given relative nitrogen inelasticity. In the US, yields in the 2021/22 season have been low, with the USDA estimating corn carry out at 1.2 billion bushels, 30% below the ten-year average.

- Farmer sentiment across grain exporting countries remains positive as input costs have been offset by higher crop prices, incentivizing farmers to plant more acres across all crops, but particularly corn.

- High forward grain prices (US corn futures at $6.45 from Q4 2022 to the end of 2024 compared to $3.5 / bushel in the last five years) are supportive of sustaining farm incomes and incentivizing demand until at least 2024 to help build grain stocks.

- Nitrogen supply is expected to be structurally tighter over 2023 – 2026, resulting in an estimated market deficit of c.7 million tons for urea and the merchant ammonia market is also structurally short:

- visibility on new supply additions as it takes four to five years to build a greenfield plant from design to commissioning. Further, increased environmental focus is a barrier to entry limiting grey capacity additions. Also of note, replacement values are higher than in the last cycle of capacity additions due to inflationary pressures.

- . Even if most of the local production restarts, European farmers are underserved and will be reliant on imports.

- , normalising the impact from the Ukraine conflict. Russian ammonia exports, however, are limited due to logistical constraints and exports are down c.50% compared to last year.

- Urea exports from China, needed to balance the markets, are expected to remain low over the medium term, with controls to curb exports in place at least until H2 2023 to prioritize domestic supply.

- is expected to remain volatile in the short-term given weather and regulatory intervention, and are expected to remain significantly above historical averages:

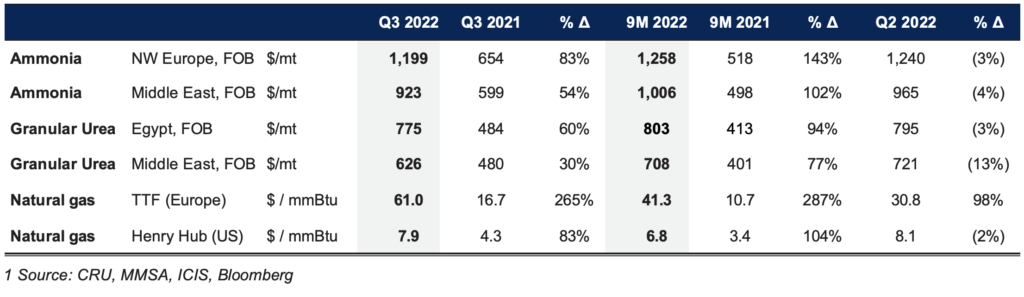

- European nitrogen producers are currently the marginal producer with the forward curve for natural gas implying elevated input costs for the medium term. Gas futures in Europe indicate c.$38 / mmBtu for 2023 (6% higher y-o-y) and c.$30 / mmBtu in 2024/25, compared to $5 / mmBtu in the 2016 to 2020 period.

- winter 2022/23 gas balances appear manageable given sufficient storage and based on expectations of warm weather. Nonetheless, European gas fundamentals are expected to be tighter in 2023 compared to 2022 given limited Russian gas flows which cannot be made up with incremental LNG volumes, government intervention incentivising gas consumption and higher Asian imports combined with high coal pricing setting a floor.

- At these higher feedstock prices, marginal costs imply ammonia support levels at >$1,300/t in 2023 and $950/t in 2024/25 (excluding CO2 costs), which is 4-6x higher than the c.$230/t support level during 2016 – 2020.

- Further upside is expected from the emerging incremental demand for clean ammonia in new applications across a range of sectors including power and marine fuels, and as a hydrogen carrier

Dividends and capital structure

Fertiglobe’s dividend policy is to substantially pay out all excess free cash flows after providing for growth opportunities, while maintaining investment grade credit ratings (S&P: BBB-, Moody’s: Baa3, Fitch: BBB-; all with stable outlooks). Based on the current visibility on Fertiglobe’s order book and its favourable positioning on the global cost curve, management is guiding for H2 2022 dividends at a minimum of $700 million or the equivalent of AED 0.31 per share, payable in April 2023. The exact amount of the H2 2022 dividend will be announced in February 2023 with Q4 2022 results. During calendar year 2022, Fertiglobe paid cash dividends of $1.1 billion.

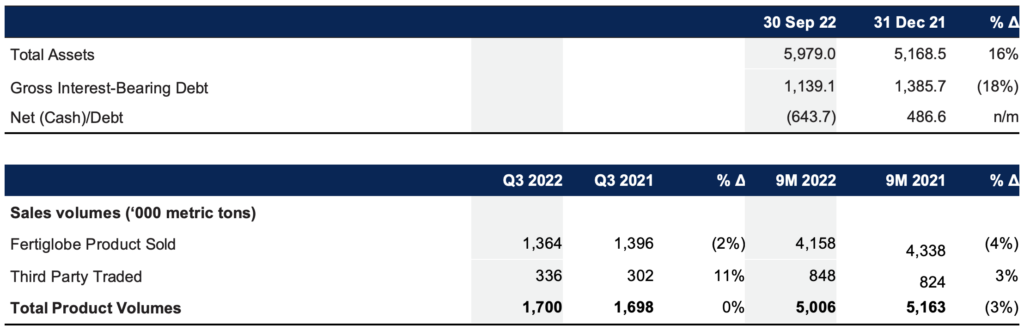

Strong earnings and cash generation during the quarter resulted in a net cash position of $644 million as of 30 September 2022, compared to net debt of $487 million as at 31 December 2021 (0.3x net debt / adjusted EBITDA), supporting future growth opportunities and an attractive dividend pay-out.

Financial Highlights ($ million, unless otherwise stated)

Operational Highlights

Highlights:

- 12-month rolling recordable incident rate to 30 September 2022 of 0.25 incidents per 200,000 manhours.

- Fertiglobe’s improved performance in Q3 2022 compared to Q3 2021 is due to an increase in selling prices across its product portfolio.

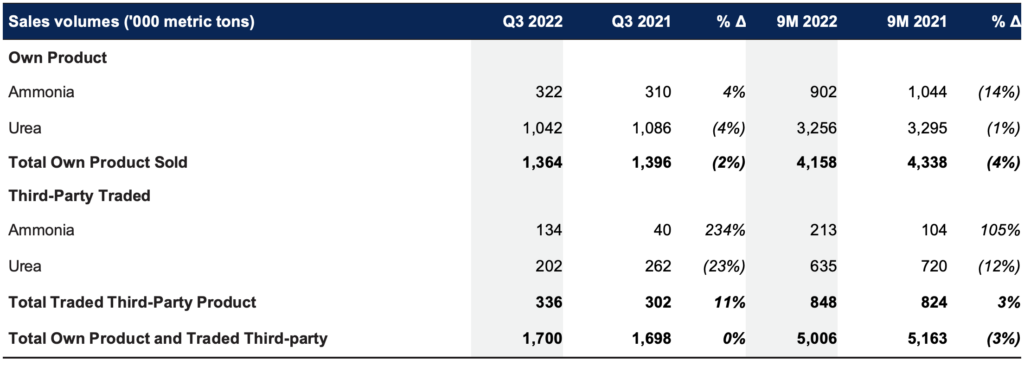

- Fertiglobe’s total own-produced sales volumes were down 2% to 1,364kt in Q3 2022 vs Q3 2021, driven by:

- 4% increase in ammonia own-produced sales volumes to 322kt from 310kt in Q3 2021, more than offset by

- 4% decrease in urea own-produced sales volumes of 1,042kt YoY compared to 1,086kt in Q3 2021.

- Traded third party volumes increased 11% YoY to 336kt in Q3 2022, compared to 302kt in Q3 2021.

- Total own-produced and traded third party volumes were relatively unchanged in Q3 2022, compared to Q3 2021.

- In 9M 2022, Fertiglobe’s total own-produced sales volumes were down 4% to 4,158kt compared to 9M 2021, driven by:

- 14% decrease in ammonia own-produced sales volumes to 902kt from 1,044kt in 9M 2021, and

- Relatively unchanged urea own-produced sales volumes of 3,256kt.

- Traded third party volumes were up 3% YoY to 848kt in 9M 2022.

- Middle East ammonia and Egypt urea benchmark prices were 54% and 60% higher YoY, respectively, in Q3 2022.

Product sales volumes (‘000 metric tons)

Benchmark prices1

Operational Performance

Total own-produced sales volumes were down 2% during the third quarter of 2022 to 1,364kt compared to the same period last year.

Ammonia and urea selling prices were significantly above prices seen in Q3 2021, with ammonia Middle East benchmark up 54% YoY and the urea Egypt benchmark price up 60%.

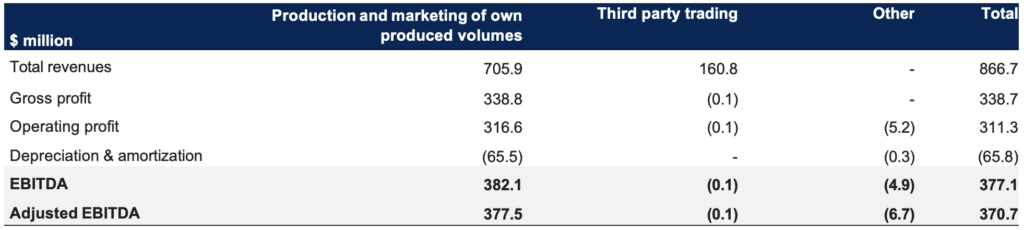

The higher selling prices resulted in a 52% YoY increase in revenues to $1,318 million in Q3 2022. This translated into a 64% increase in adjusted EBITDA to $606 million in Q3 2022 from $371 million in Q3 2021. As a result, Fertiglobe’s adjusted EBITDA margin expanded to 46.0% in Q3 2022 from 42.8% in Q3 2021.

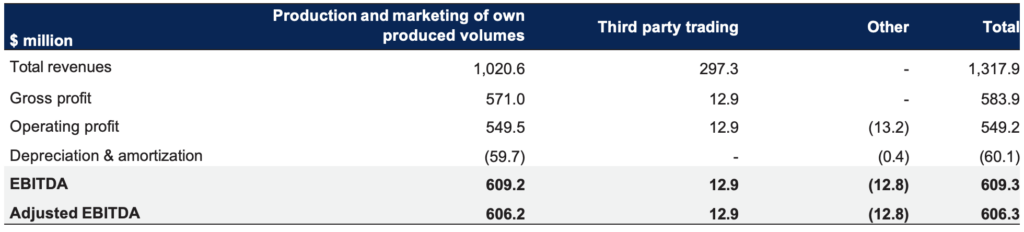

Segment overview Q3 2022

Segment overview Q3 2021

Segment overview 9M 2022

Segment overview 9M 2021

Financial Highlights

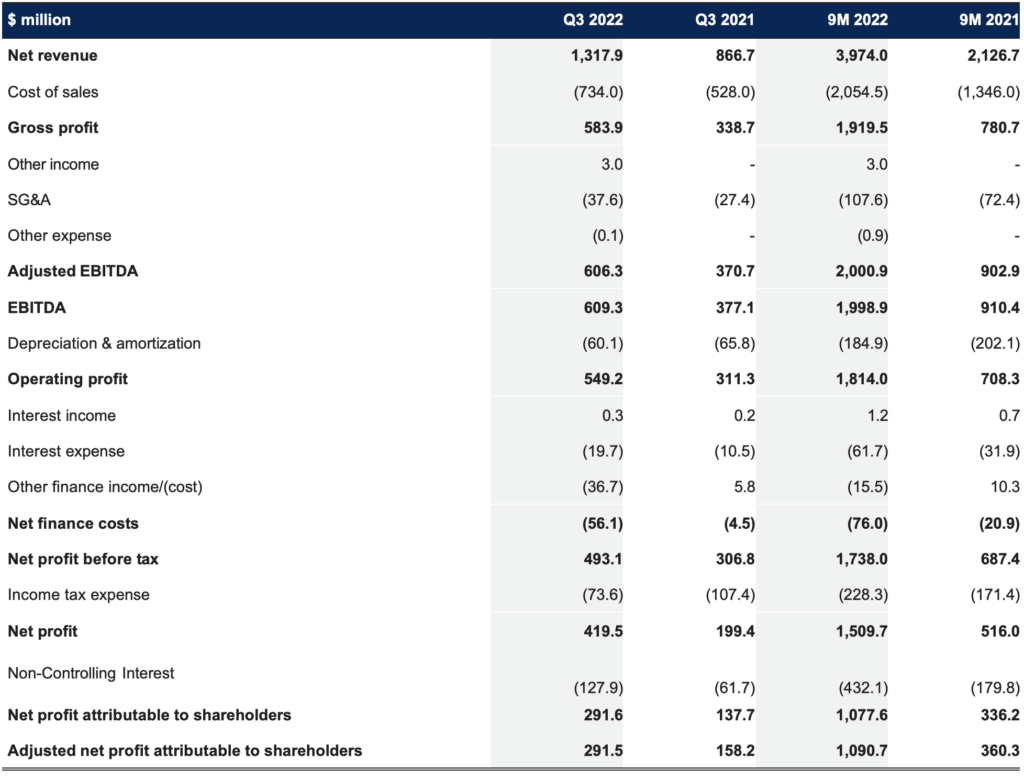

Summary results

Consolidated revenue increased by 52% to $1,318 million in the third quarter of 2022 compared to the same quarter in 2021, driven by higher prices across the board of Fertiglobe’s product portfolio.

Adjusted EBITDA grew 64% YoY to $606 million in Q3 2022 compared to $371 million in Q3 2021. Fertiglobe benefited from higher selling prices during the quarter, which have more than offset higher profit sharing.

Q3 2022 adjusted net profit was $292 million compared to an adjusted net profit of $158 million in Q3 2021. Reported net profit attributable to shareholders was $292 million in Q3 2022 compared to a net profit attributable to shareholders of $138 million in Q3 2021.

Consolidated statement of income

Reconciliation to Alternative Performance Measures

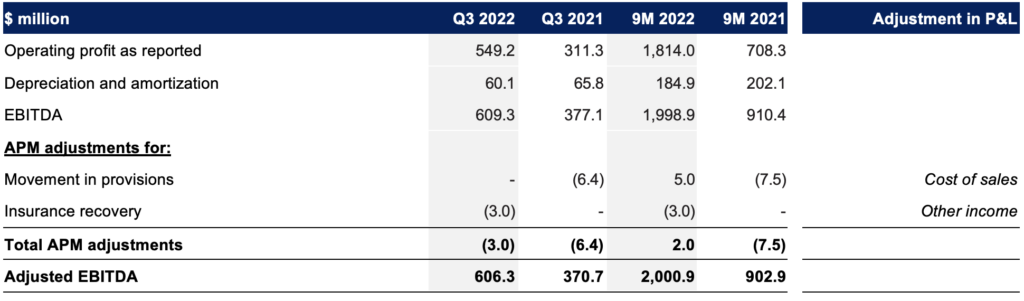

Adjusted EBITDA

Adjusted EBITDA is an Alternative Performance Measure (APM) that intends to give a clear reflection of underlying performance of Fertiglobe’s operations. The main APM adjustments at EBITDA level relate to the movement in provisions and insurance recovery.

Reconciliation of reported operating income to adjusted EBITDA

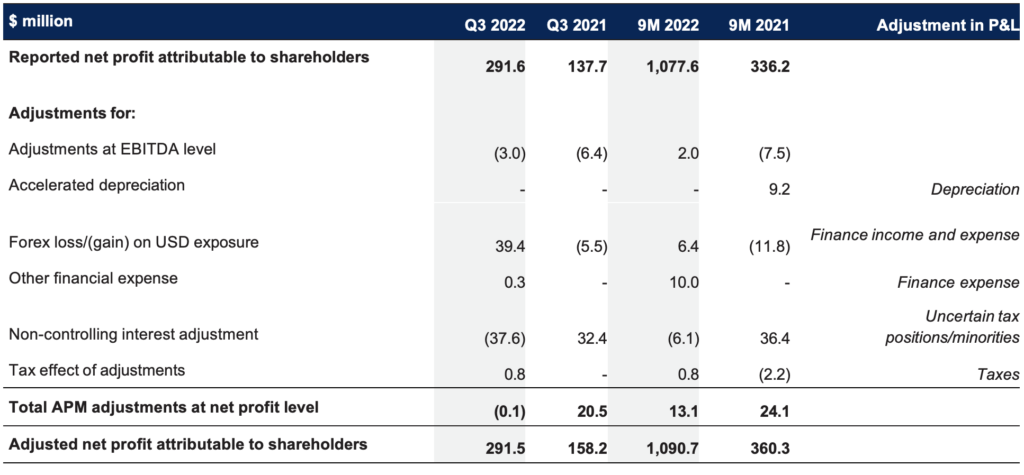

Adjusted net profit attributable to shareholders

At the net profit level, the main APM adjustments relate to the impact on non-cash foreign exchange gains and losses on USD exposure and other financial expenses.

Reconciliation of reported net profit to adjusted net profit

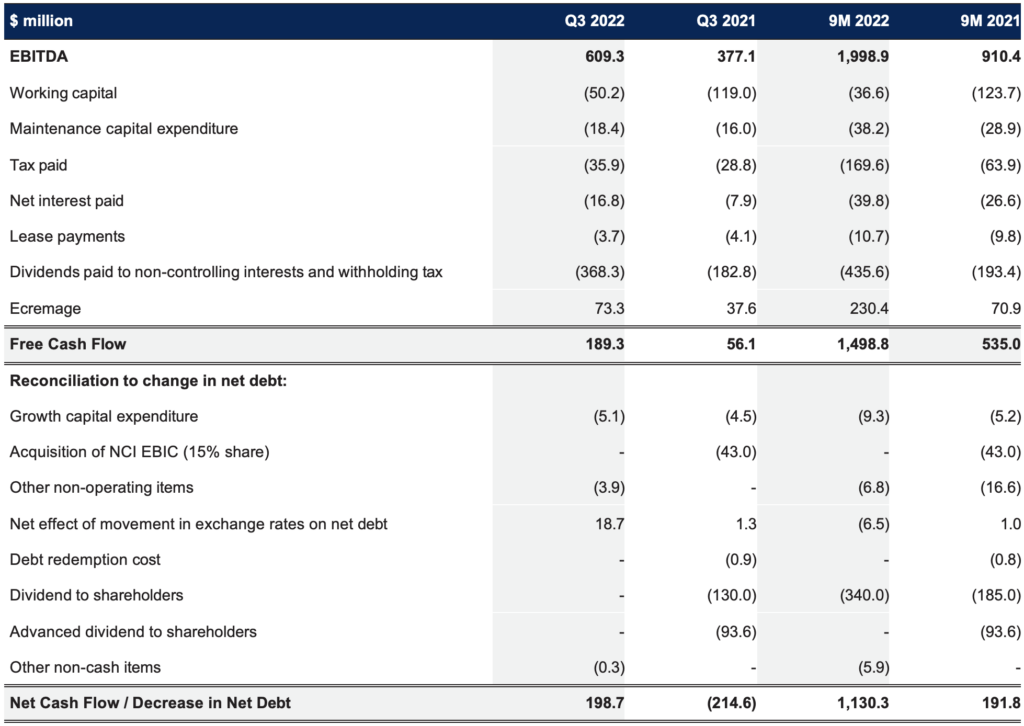

Free Cash Flow and Net Debt

Free cash flow before growth capex amounted to $189 million during Q3 2022, compared to $56 million during the same period last year, reflecting performance for the quarter, offset by dividends paid to non-controlling interests, working capital outflows and taxes.

Total cash capital expenditures including growth capex were $24 million in Q3 2022 compared to $21 million in Q3 2021. Management continues to expect 2022 capital expenditures (excluding growth capital expenditure) to be in the range of $120-140 million.

Reconciliation of EBITDA to Free Cash Flow and Change in Net Debt

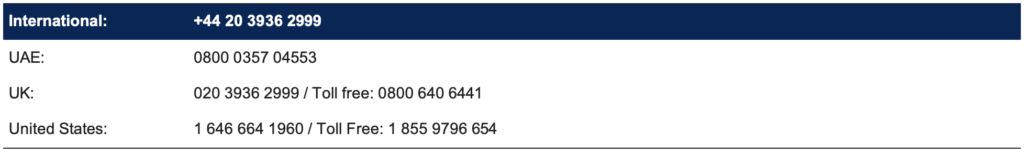

Investor and Analyst Conference Call

On 3 November 2022 at 4:00 PM UAE (12:00 PM London, 8:00 AM New York), Fertiglobe will host a conference call for investors and analysts. To access the call please dial:

Passcode: 544922

About Fertiglobe

Fertiglobe is the world’s largest seaborne exporter of urea and ammonia combined, and an early mover in clean ammonia. Fertiglobe’s production capacity comprises of 6.7 million tons of urea and merchant ammonia, produced at four subsidiaries in the UAE, Egypt and Algeria, making it the largest producer of nitrogen fertilizers in the Middle East and North Africa (MENA), and benefits from direct access to six key ports and distribution hubs on the Mediterranean Sea, Red Sea, and the Arab Gulf. Headquartered in Abu Dhabi and incorporated in Abu Dhabi Global Market (ADGM), Fertiglobe employs more than 2,600 employees and was formed as a strategic partnership between OCI N.V. (“OCI”) and the Abu Dhabi National Oil Company (“ADNOC”). Fertiglobe is listed on the Abu Dhabi Securities Exchange (“ADX”) under the symbol “FERTIGLB” and ISIN “AEF000901015. To find out more, visit: www.fertiglobe.com

Fertiglobe Investor Relations

Hans Zayed

Director

[email protected]

Rita Guindy

Director

[email protected]

For additional information on Fertiglobe: